Page 49 - UKRRptSept23

P. 49

7.0 FX

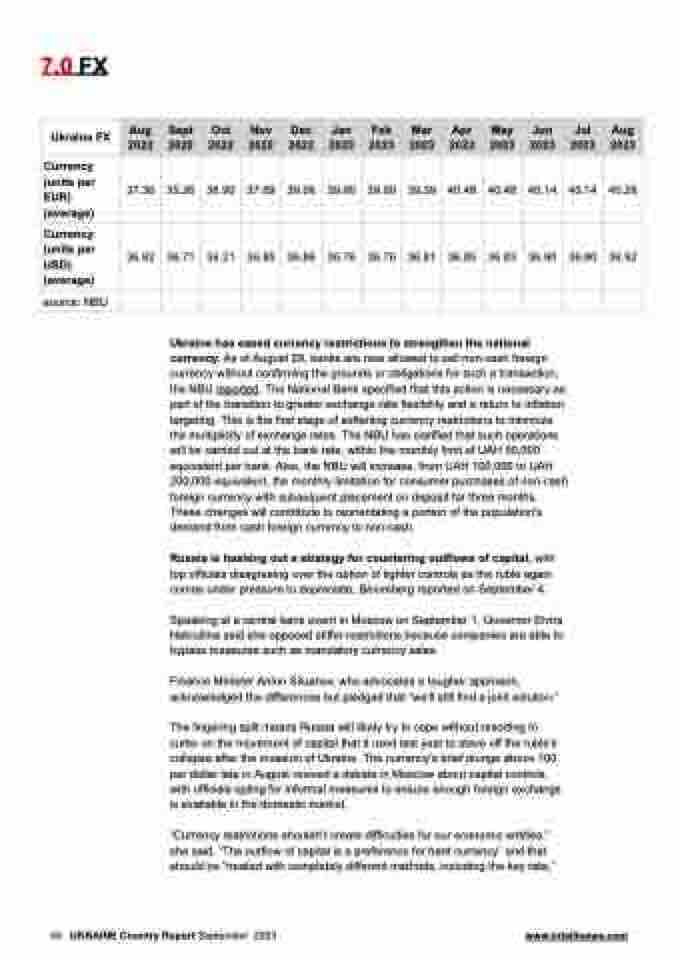

Ukraine FX

Aug 2022

Sept 2022

Oct 2022

Nov 2022

Dec 2022

Jan 2023

Feb 2023

Mar 2023

Apr 2023

May 2023

Jun 2023

Jul 2023

Aug 2023

Currency (units per EUR) (average)

37.36

35.26

36.90

37.69

39.06

39.60

39.60

39.39

40.48

40.48

40.14

40.14

40.26

Currency (units per USD) (average)

36.92

36.71

36.21

36.85

36.86

36.76

36.76

36.81

36.85

36.83

36.90

36.90

36.92

source: NBU

Ukraine has eased currency restrictions to strengthen the national currency. As of August 29, banks are now allowed to sell non-cash foreign currency without confirming the grounds or obligations for such a transaction, the NBU reported. The National Bank specified that this action is necessary as part of the transition to greater exchange rate flexibility and a return to inflation targeting. This is the first stage of softening currency restrictions to minimize the multiplicity of exchange rates. The NBU has clarified that such operations will be carried out at the bank rate, within the monthly limit of UAH 50,000 equivalent per bank. Also, the NBU will increase, from UAH 100,000 to UAH 200,000 equivalent, the monthly limitation for consumer purchases of non-cash foreign currency with subsequent placement on deposit for three months. These changes will contribute to reorientating a portion of the population's demand from cash foreign currency to non-cash.

Russia is hashing out a strategy for countering outflows of capital, with top officials disagreeing over the option of tighter controls as the ruble again comes under pressure to depreciate, Bloomberg reported on September 4.

Speaking at a central bank event in Moscow on September 1, Governor Elvira Nabiullina said she opposed stiffer restrictions because companies are able to bypass measures such as mandatory currency sales.

Finance Minister Anton Siluanov, who advocates a tougher approach, acknowledged the differences but pledged that “we’ll still find a joint solution.”

The lingering split means Russia will likely try to cope without resorting to curbs on the movement of capital that it used last year to stave off the ruble’s collapse after the invasion of Ukraine. The currency’s brief plunge above 100 per dollar late in August revived a debate in Moscow about capital controls, with officials opting for informal measures to ensure enough foreign exchange is available in the domestic market.

“Currency restrictions shouldn’t create difficulties for our economic entities,” she said. “The outflow of capital is a preference for hard currency” and that should be “treated with completely different methods, including the key rate,”

49 UKRAINE Country Report September 2023 www.intellinews.com