Page 57 - UKRRptSept23

P. 57

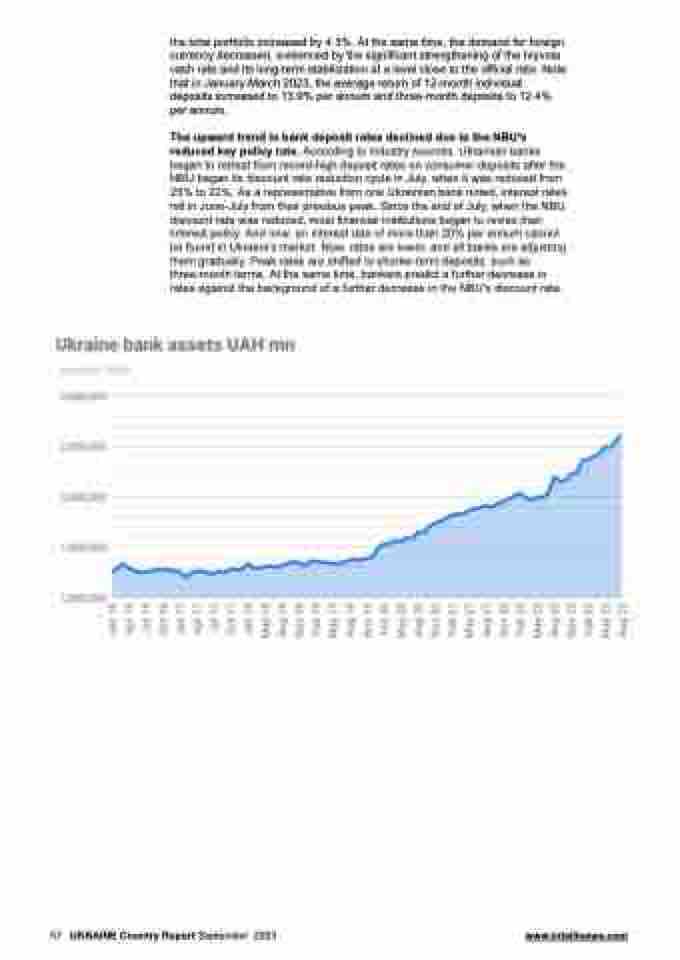

the total portfolio increased by 4.3%. At the same time, the demand for foreign currency decreased, evidenced by the significant strengthening of the hryvnia cash rate and its long-term stabilization at a level close to the official rate. Note that in January-March 2023, the average return of 12-month individual deposits increased to 13.9% per annum and three-month deposits to 12.4% per annum.

The upward trend in bank deposit rates declined due to the NBU's reduced key policy rate. According to industry sources, Ukrainian banks began to retreat from record-high deposit rates on consumer deposits after the NBU began its discount rate reduction cycle in July, when it was reduced from 25% to 22%. As a representative from one Ukrainian bank noted, interest rates fell in June-July from their previous peak. Since the end of July, when the NBU discount rate was reduced, most financial institutions began to revise their interest policy. And now, an interest rate of more than 20% per annum cannot be found in Ukraine's market. Now, rates are lower, and all banks are adjusting them gradually. Peak rates are shifted to shorter-term deposits, such as three-month terms. At the same time, bankers predict a further decrease in rates against the background of a further decrease in the NBU's discount rate.

57 UKRAINE Country Report September 2023 www.intellinews.com