Page 61 - UKRRptSept23

P. 61

year, was a net profit of more than UAH 43B ($1.17B), and the bank's assets increased by 17% to UAH 2.29T, the bank reported. It is noted that the main reason for the growth of assets is a 37% increase in the volume of international reserves, which, as of July, amounted to $39B against $28.5B at the end of 2022. In particular, the volume of non-residents' securities increased by 23% to UAH 858.5B in half a year. The volumes of currency deposits and bank metals almost doubled to UAH 464.4B. At the same time, the NBU's loan portfolio volume decreased by almost 80% due to bank repayment of long-term loan debt. The NBU's administrative and other expenses amounted to UAH 3B. Liabilities as of July 1 are 83.8% of assets, or UAH 1.9B. An increase in the size of the NBU's equity in the first half of the year by 13% occurred because of the current year's profit accumulation.

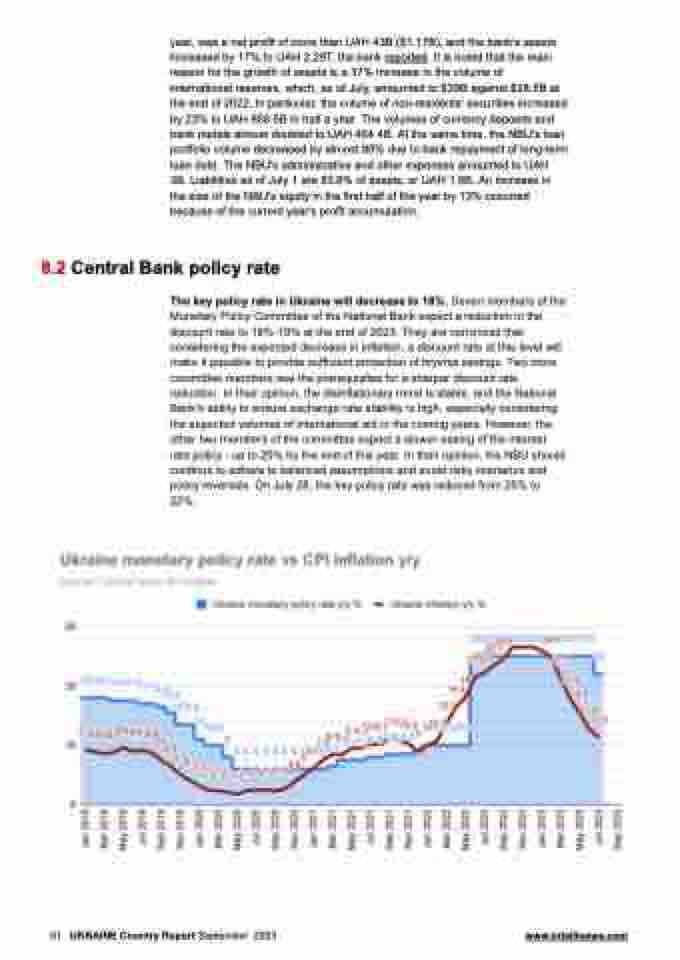

8.2 Central Bank policy rate

The key policy rate in Ukraine will decrease to 18%. Seven members of the Monetary Policy Committee of the National Bank expect a reduction in the discount rate to 18%-19% at the end of 2023. They are convinced that considering the expected decrease in inflation, a discount rate at this level will make it possible to provide sufficient protection of hryvnia savings. Two more committee members see the prerequisites for a sharper discount rate reduction. In their opinion, the disinflationary trend is stable, and the National Bank's ability to ensure exchange rate stability is high, especially considering the expected volumes of international aid in the coming years. However, the other two members of the committee expect a slower easing of the interest rate policy - up to 20% by the end of this year. In their opinion, the NBU should continue to adhere to balanced assumptions and avoid risky scenarios and policy reversals. On July 28, the key policy rate was reduced from 25% to 22%.

61 UKRAINE Country Report September 2023 www.intellinews.com