Page 20 - Turkey Outlook 2025

P. 20

follow price increases.

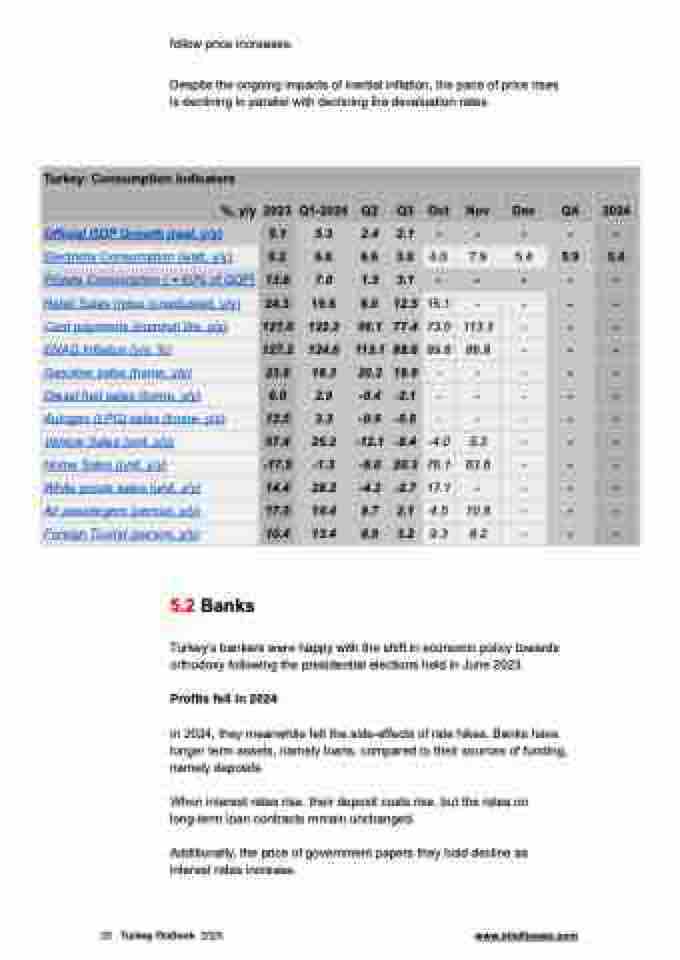

Despite the ongoing impacts of inertial inflation, the pace of price rises is declining in parallel with declining lira devaluation rates.

Turkey: Consumption indicators

%, y/y

2023

Q1-2024

Q2

Q3

Oct

Nov

Dec

Q4

2024

Official GDP Growth (real, y/y)

5.1

5.3

2.4

2.1

-

-

-

-

-

Electricity Consumption (watt, y/y)

0.2

6.8

6.6

3.0

4.0

7.9

5.4

5.9

5.4

Private Consumption ( ≈ 60% of GDP)

13.6

7.0

1.5

3.1

-

-

-

-

-

Retail Sales Index (unadjusted, y/y)

24.3

19.8

8.0

12.5

15.1

-

-

-

-

Card payments (nominal lira, y/y)

121.0

122.2

99.1

77.4

73.0

113.3

-

-

-

ENAG Inflation (y/y, %)

127.2

124.6

113.1

88.6

89.8

86.8

-

-

-

Gasoline sales (tonne, y/y)

23.6

18.3

20.2

19.9

-

-

-

-

-

Diesel fuel sales (tonne, y/y)

6.0

2.9

-0.4

-2.1

-

-

-

-

-

Autogas (LPG) sales (tonne, y/y)

13.5

3.3

-0.9

-5.6

-

-

-

-

-

Vehicle Sales (unit, y/y)

57.4

25.2

-12.1

-9.4

-4.0

5.3

-

-

-

Home Sales (unit, y/y)

-17.5

-1.3

-6.0

20.3

76.1

63.6

-

-

-

White goods sales (unit, y/y)

14.4

28.2

-4.2

-2.7

17.1

-

-

-

-

Air passengers (person, y/y)

17.5

14.4

9.7

2.1

4.5

10.8

-

-

-

Foreign Tourist (person, y/y)

10.4

13.4

8.9

3.2

9.3

8.2

-

-

-

5.2 Banks

Turkey’s bankers were happy with the shift in economic policy towards

orthodoxy following the presidential elections held in June 2023.

Profits fell in 2024

In 2024, they meanwhile felt the side-effects of rate hikes. Banks have longer term assets, namely loans, compared to their sources of funding, namely deposits.

When interest rates rise, their deposit costs rise, but the rates on long-term loan contracts remain unchanged.

Additionally, the price of government papers they hold decline as interest rates increase.

20 Turkey Outlook 2025 www.intellinews.com