Page 23 - Turkey Outlook 2025

P. 23

When the finance industry decides to stop financing Turkey’s trade deficit, sharp corrections in the currency take place. Sooner or later, a sharp monetary tightening is employed to curb economic activity and, as a result, the trade deficit.

The country is currently in the sharp monetary tightening phase of this cycle, and industrial activity along with exports is declining.

So far, a significant wave of bankruptcies has not occurred thanks to the regulatory forbearance measures. The regime simply does not let companies go bankrupt. Instead, it keeps them afloat with cheap financing.

In 2025, rate cuts are expected to help avoid bigger troubles.

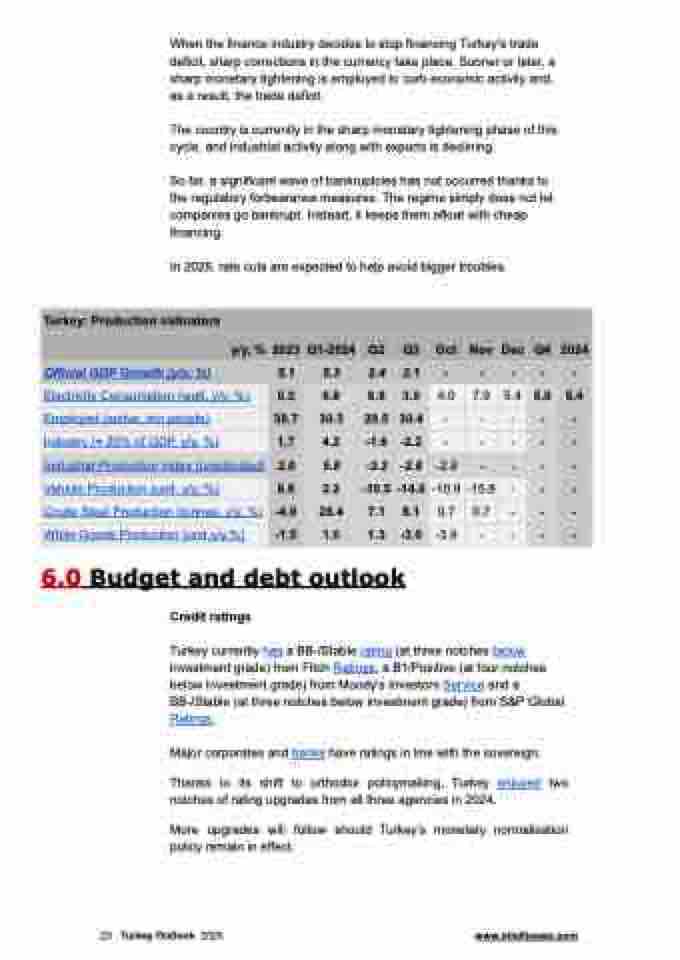

Turkey: Production indicators

y/y, %

2023

Q1-2024

Q2

Q3

Oct

Nov

Dec

Q4

2024

Official GDP Growth (y/y, %)

5.1

5.3

2.4

2.1

-

-

-

-

-

Electricity Consumption (watt, y/y, %)

0.2

6.8

6.6

3.0

4.0

7.9

5.4

5.9

5.4

Employed (active, mn people)

30.7

30.3

29.5

30.4

-

-

-

-

-

Industry (≈ 20% of GDP, y/y, %)

1.7

4.2

-1.6

-2.2

-

-

-

-

-

Industrial Production Index (unadjusted)

2.0

5.8

-3.2

-2.8

-2.9

-

-

-

-

Vehicle Production (unit, y/y, %)

8.8

2.2

-10.5

-14.0

-10.9

-15.8

-

-

-

Crude Steel Production (tonnes, y/y, %)

-4.0

28.4

7.1

8.1

0.7

0.7

-

-

-

White Goods Production (unit,y/y,%)

-1.5

1.0

1.3

-3.0

-3.9

-

-

-

-

6.0 Budget and debt outlook

Credit ratings

Turkey currently has a BB-/Stable rating (at three notches below investment grade) from Fitch Ratings, a B1/Positive (at four notches below investment grade) from Moody’s Investors Service and a BB-/Stable (at three notches below investment grade) from S&P Global Ratings.

Major corporates and banks have ratings in line with the sovereign. Thanks to its shift to orthodox policymaking, Turkey enjoyed two

notches of rating upgrades from all three agencies in 2024.

More upgrades will follow should Turkey’s monetary normalisation policy remain in effect.

23 Turkey Outlook 2025 www.intellinews.com