Page 31 - bne IntelliNews monthly magazine December 2023

P. 31

bne December 2023 Cover story I 31

Poor PMIs

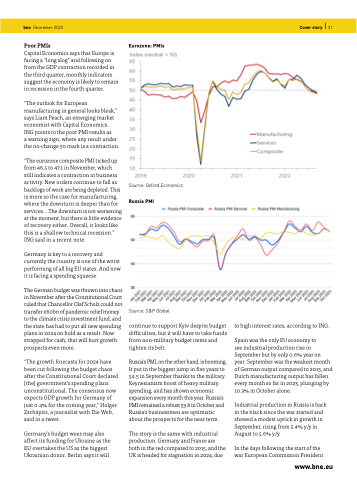

Capital Economics says that Europe is facing a “long slog” and following on from the GDP contraction recorded in the third quarter, monthly indicators suggest the economy is likely to remain in recession in the fourth quarter.

“The outlook for European manufacturing in general looks bleak,” says Liam Peach, an emerging market economist with Capital Economics. ING points to the poor PMI results as

a warning sign, where any result under the no-change 50 mark is a contraction.

“The eurozone composite PMI ticked up from 46.5 to 47.1 in November, which still indicates a contraction in business activity. New orders continue to fall as backlogs of work are being depleted. This is more so the case for manufacturing, where the downturn is deeper than for services... The downturn is not worsening at the moment, but there is little evidence of recovery either. Overall, it looks like this is a shallow technical recession.” ING said in a recent note.

Germany is key to a recovery and currently the country is one of the worst performing of all big EU states. And now it is facing a spending squeeze.

The German budget was thrown into chaos in November after the Constitutional Court ruled that Chancellor Olaf Scholz could not transfer €60bn of pandemic relief money to the climate crisis investment fund, and the state has had to put all new spending plans in 2024 on hold as a result. Now strapped for cash, that will hurt growth prospects even more.

“The growth forecasts for 2024 have been cut following the budget chaos after the Constitutional Court declared [the] government’s spending plans unconstitutional. The consensus now expects GDP growth for Germany of just 0.4% for the coming year,” Holger Zschäpitz, a journalist with Die Welt, said in a tweet.

Germany’s budget woes may also affect its funding for Ukraine as the EU overtakes the US as the biggest Ukrainian donor. Berlin says it will

Eurozone: PMIs

Source: Oxford Economics

Russia PMI

Source: S&P Global

continue to support Kyiv despite budget difficulties, but it will have to take funds from non-military budget items and tighten its belt.

Russia’s PMI, on the other hand, is booming. It put in the biggest jump in five years to 54.5 in September thanks to the military Keynesianism boost of heavy military spending, and has shown economic expansion every month this year. Russia’s PMI remained a robust 53.8 in October and Russia’s businessmen are optimistic about the prospects for the near term.

The story is the same with industrial production. Germany and France are both in the red compared to 2015, and the UK is headed for stagnation in 2024, due

to high interest rates, according to ING.

Spain was the only EU economy to

see industrial production rise in September but by only 0.6% year on year. September was the weakest month of German output compared to 2015, and Dutch manufacturing output has fallen every month so far in 2023, plunging by 10.3% in October alone.

Industrial production in Russia is back in the black since the war started and showed a modest uptick in growth in September, rising from 5.4% y/y in August to 5.6% y/y.

In the days following the start of the war European Commission President

www.bne.eu