Page 103 - RusRPTFeb24

P. 103

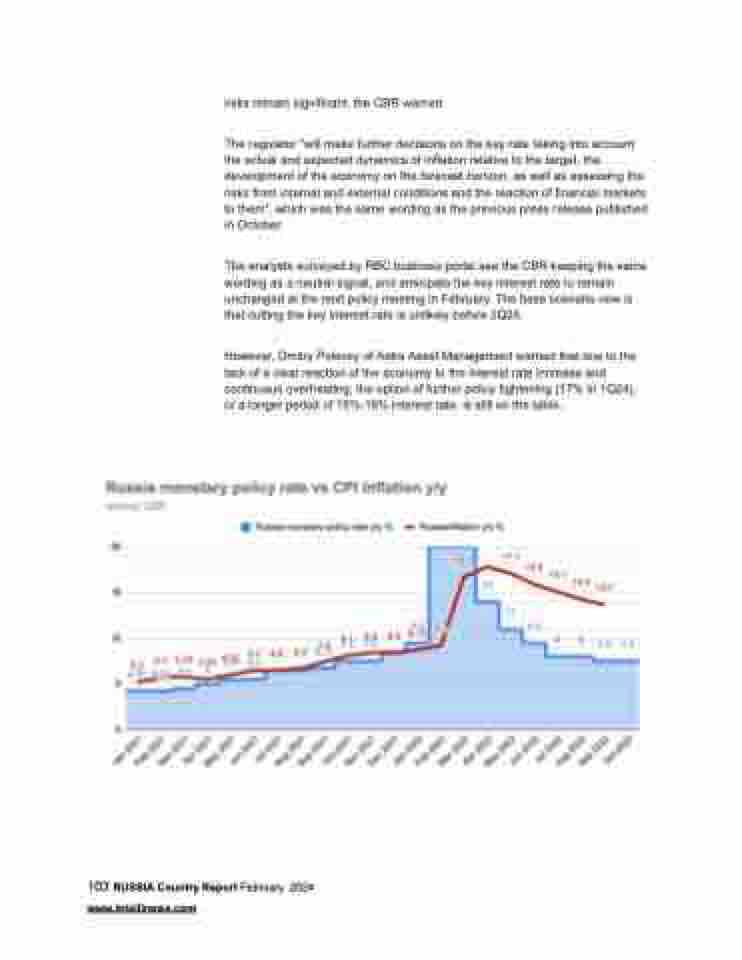

risks remain significant, the CBR warned.

The regulator "will make further decisions on the key rate taking into account the actual and expected dynamics of inflation relative to the target, the development of the economy on the forecast horizon, as well as assessing the risks from internal and external conditions and the reaction of financial markets to them", which was the same wording as the previous press release published in October.

The analysts surveyed by RBC business portal see the CBR keeping the same wording as a neutral signal, and anticipate the key interest rate to remain unchanged at the next policy meeting in February. The base scenario now is that cutting the key interest rate is unlikely before 2Q24.

However, Dmitry Polevoy of Astra Asset Management warned that due to the lack of a clear reaction of the economy to the interest rate increase and continuous overheating, the option of further policy tightening (17% in 1Q24), or a longer period of 15%-16% interest rate, is still on the table.

103 RUSSIA Country Report February 2024 www.intellinews.com