Page 62 - bne Magazine February 2023

P. 62

62 I Eastern Europe bne February 2023

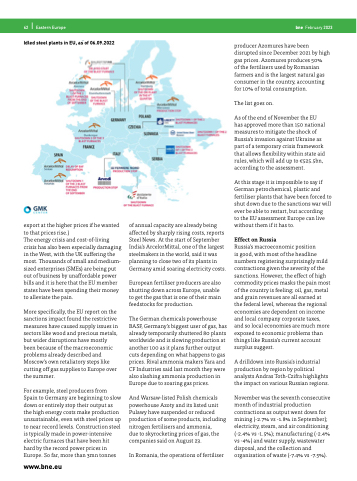

Idled steel plants in EU, as of 06.09.2022

producer Azomures have been disrupted since December 2021 by high gas prices. Azomures produces 50%

of the fertilisers used by Romanian farmers and is the largest natural gas consumer in the country, accounting for 10% of total consumption.

The list goes on.

As of the end of November the EU has approved more than 150 national measures to mitigate the shock of Russia’s invasion against Ukraine as part of a temporary crisis framework that allows flexibility within state aid rules, which will add up to €525.5bn, according to the assessment.

At this stage it is impossible to say if German petrochemical, plastic and fertiliser plants that have been forced to shut down due to the sanctions war will ever be able to restart, but according

to the EU assessment Europe can live without them if it has to.

Effect on Russia

Russia’s macroeconomic position

is good, with most of the headline numbers registering surprisingly mild contractions given the severity of the sanctions. However, the effect of high commodity prices masks the pain most of the country is feeling; oil, gas, metal and grain revenues are all earned at the federal level, whereas the regional economies are dependent on income and local company corporate taxes, and so local economies are much more exposed to economic problems than things like Russia’s current account surplus suggest.

A drilldown into Russia’s industrial production by region by political analysts Andras Toth-Czifra highlights the impact on various Russian regions.

November was the seventh consecutive month of industrial production contractions as output went down for mining (-2.7% vs -1.8% in September); electricity, steam, and air conditioning (-2.4% vs -1.5%); manufacturing (-2.4% vs -4%) and water supply, wastewater disposal, and the collection and organisation of waste (-7.4% vs -7.5%).

export at the higher prices if he wanted to that prices rise.)

The energy crisis and cost-of-living crisis has also been especially damaging in the West, with the UK suffering the most. Thousands of small and medium- sized enterprises (SMEs) are being put out of business by unaffordable power bills and it is here that the EU member states have been spending their money to alleviate the pain.

More specifically, the EU report on the sanctions impact found the restrictive measures have caused supply issues in sectors like wood and precious metals, but wider disruptions have mostly been because of the macroeconomic problems already described and Moscow’s own retaliatory steps like cutting off gas supplies to Europe over the summer.

For example, steel producers from Spain to Germany are beginning to slow down or entirely stop their output as the high energy costs make production unsustainable, even with steel prices up to near record levels. Construction steel is typically made in power-intensive electric furnaces that have been hit hard by the record power prices in Europe. So far, more than 3mn tonnes

www.bne.eu

of annual capacity are already being affected by sharply rising costs, reports Steel News. At the start of September India’s ArcelorMittal, one of the largest steelmakers in the world, said it was planning to close two of its plants in Germany amid soaring electricity costs.

European fertiliser producers are also shutting down across Europe, unable to get the gas that is one of their main feedstocks for production.

The German chemicals powerhouse BASF, Germany’s biggest user of gas, has already temporarily shuttered 80 plants worldwide and is slowing production at another 100 as it plans further output cuts depending on what happens to gas prices. Rival ammonia makers Yara and CF Industries said last month they were also slashing ammonia production in Europe due to soaring gas prices.

And Warsaw-listed Polish chemicals powerhouse Azoty and its listed unit Pulawy have suspended or reduced production of some products, including nitrogen fertilisers and ammonia,

due to skyrocketing prices of gas, the companies said on August 23.

In Romania, the operations of fertiliser