Page 40 - SE Outlook Regions 2024

P. 40

The manufacturing industries posted worse performances with a 8.5% y/y decline for the 12-month period to September.

There are, however, pockets of growth, such as in the manufacturing of electric equipment (+21.4% y/y in the 12-month period), electronic equipment (+6.6% y/y) and other machinery (+118% y/y). These sectors are associated with foreign investors in the car parts and electronics parts industries.

The manufacturing of pharmaceuticals also saw a robust 25.7% y/y advance. The country’s major medicines producer, Balkan Pharmaceuticals, is heavily expanding, including with a factory in Romania scheduled for completion in 2023.

Metallurgy also posted a robust positive 12.4% y/y advance. This comes on top of significant advances in 2022. New steel company Omnisteel was set up in 2021 and in 2022 it already took over half of the capital of Laminorul Danube Metallurgical Enterprise (LDME), which owns and operates the steel pipe production unit in Romania.

In contrast, food manufacturing is losing ground (-11.5% y/y), but this is after a 24.5% y/y advance in 2022.

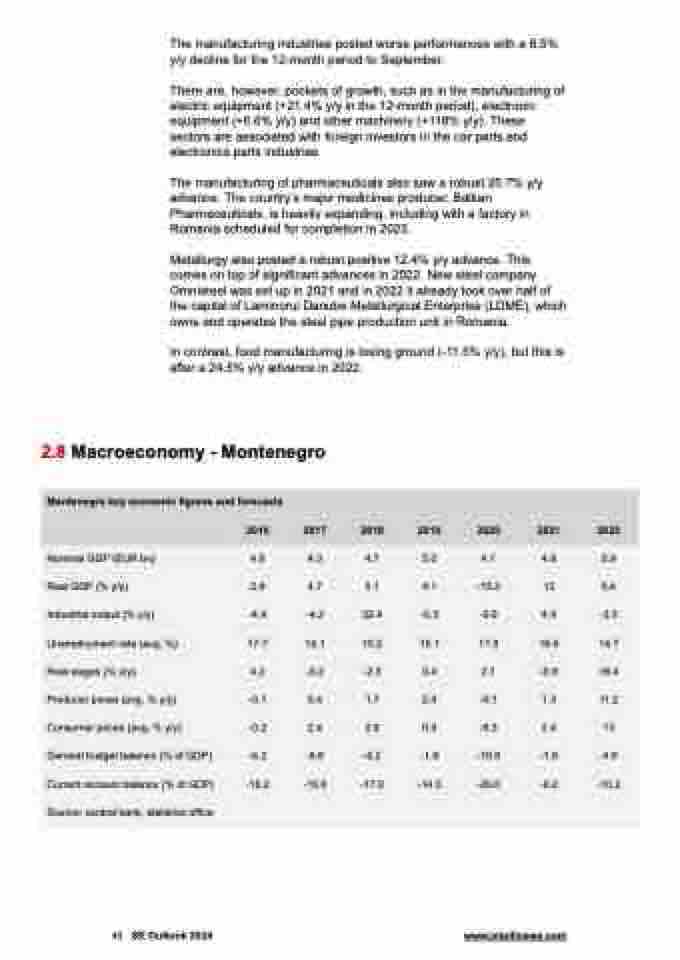

2.8 Macroeconomy - Montenegro

Montenegro key economic figures and forecasts

2016 2017 2018 2019 2020 2021 2022

Nominal GDP (EUR bn) 4.0 4.3 4.7 5.0 4.1 4.9 5.9

Real GDP (% y/y) 2.9 4.7 5.1 4.1 -15.3 13 6.4

Industrial output (% y/y) -4.4 -4.2 22.4 -6.3 -0.9 4.9 -3.3

Unemployment rate (avg, %) 17.7 16.1 15.2 15.1 17.9 16.6 14.7

Real wages (% y/y) 4.2 -0.2 -2.3 0.4 2.1 -0.9 18.4

Producer prices (avg, % y/y) -0.1 0.4 1.7 2.4 -0.1 1.3 11.2

Consumer prices (avg, % y/y) -0.2 2.4 2.6 0.4 -0.3 2.4 13

General budget balance (% of GDP) -6.2 -6.8 -6.2 -1.8 -10.9 -1.9 -4.9

Current account balance (% of GDP) -16.2 -16.0 -17.0 -14.3 -26.0 -9.2 -10.2 Source: central bank, statistics office

40 SE Outlook 2024 www.intellinews.com