Page 43 - SE Outlook Regions 2024

P. 43

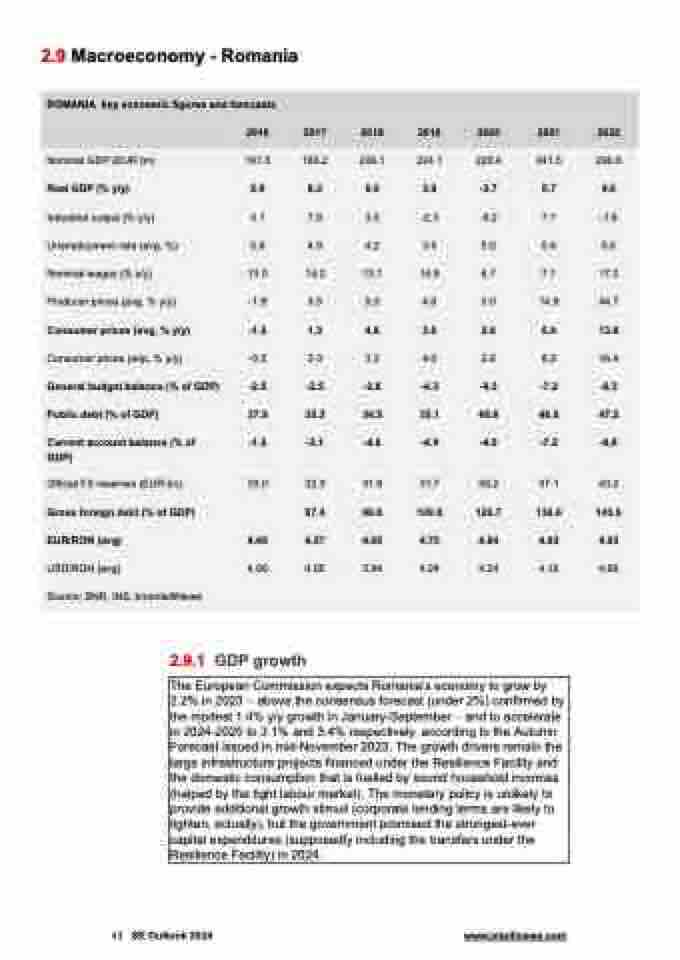

2.9 Macroeconomy - Romania

ROMANIA key economic figures and forecasts

2016 2017 2018 2019 2020 2021 2022

Nominal GDP (EUR bn) 167.5 186.2 206.1 224.1 220.4 241.5 296.0

Real GDP (% y/y) 2.9 8.2 6.0 3.9 -3.7 5.7 4.6

Industrial output (% y/y) 3.1 7.8 3.5 -2.3 -9.2 7.1 -1.8

Unemployment rate (avg, %) 5.9 4.9 4.2 3.9 5.0 5.6 5.6

Nominal wages (% y/y) 13.0 14.2 13.1 14.9 6.7 7.1 17.2

Producer prices (avg, % y/y) -1.8 3.5 5.0 4.0 0.0 14.9 44.7

Consumer prices (avg, % y/y) -1.6 1.3 4.6 3.8 2.6 5.0 13.8

Consumer prices (eop, % y/y) -0.5 3.3 3.3 4.0 2.6 8.2 16.4

General budget balance (% of GDP) -2.5 -2.5 -2.8 -4.3 -9.3 -7.2 -6.3

Public debt (% of GDP) 37.9 35.3 34.5 35.1 46.8 48.5 47.2

Current account balance (% of -1.6 -3.1 -4.6 -4.9 -4.9 -7.2 -8,8 GDP)

Official FX reserves (EUR bn) 33.0 32.3 31.9 31.7 36.2 37.1 43.2

Gross foreign debt (% of GDP) 97.4 99.8 109.8 126.7 136.6 143.9

EUR/RON (avg) 4.49 4.57 4.65 4.75 4.84 4.92 4.93

USD/RON (avg) 4.06 4.05 3.94 4.24 4.24 4.16 4.69 Source: BNR, INS, bneIntelliNews

2.9.1 GDP growth

The European Commission expects Romania’s economy to grow by 2.2% in 2023 – above the consensus forecast (under 2%) confirmed by the modest 1.4% y/y growth in January-September – and to accelerate in 2024-2025 to 3.1% and 3.4% respectively, according to the Autumn Forecast issued in mid-November 2023. The growth drivers remain the large infrastructure projects financed under the Resilience Facility and the domestic consumption that is fuelled by sound household incomes (helped by the tight labour market). The monetary policy is unlikely to provide additional growth stimuli (corporate lending terms are likely to tighten, actually), but the government promised the strongest-ever capital expenditures (supposedly including the transfers under the Resilience Facility) in 2024.

43 SE Outlook 2024 www.intellinews.com