Page 30 - TURKRptNov22

P. 30

Jun-22

Jun-22

Jun-22

May-22

Polat Enerji (AP Enerji)

Jul-22

ING Turkey

Government

QNB Finansbank (QNBFB)

Denizbank

Health Ministry

$100

$60

€50

$2

EBRD

Jun-22

Jun-22

Government

$449

€300

World Bank

100%

100%

TEFWER

367-day

grant

risk

367-day

TKYB

sharing

SOFR+2.75%

Women in Business (TurWib II)

SOFR+2.75%

364-day

€291

Euribor+2.10%

Jun-22

Denizbank

May Agro Tohumculuk

€12

World Bank

EBRD

European Union

IBRD

refugee deal

Jun-22

Jun-22

Netlog Lojistik

$50

€25

EBRD

6-year

Jun-22

Jun-22

Isbank (ISCTR)

$774

$453

EBRD

88%

120%

367-day

367-day

$257

$196

1-year grace

SOFR+2.75%

€204

€483

Euribor+2.10%

Chinese yuan 255mn

May-22

Panelsan (PNLSN)

Garanti BBVA (GARAN)

EBRD

TSKB

$594

$284

Euribor+2.10%

May-22

$500

$250

World Bank

10.5-year

5-year grace

COVID-19

vaccine

May-22

Health Ministry

Yapi Kredi (YKBNK)

Turk Eximbank

$811

$364

China

104%

118%

1-year

367-day

AIIB

$137

SOFR+2.75%

COVID-19

€504

vaccine

May-22

$745

91%

367-day

$350

$206

SOFR+2.75%

€432

Euribor+2.10%

QNB Finansbank (QNBFB)

May-22

€212

Euribor+2.10%

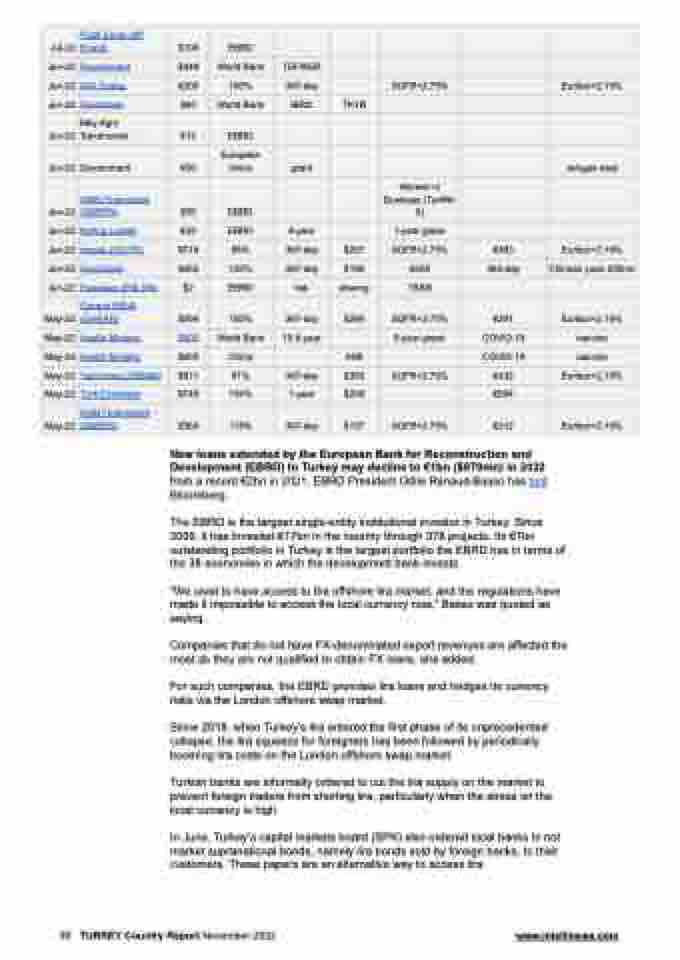

New loans extended by the European Bank for Reconstruction and Development (EBRD) to Turkey may decline to €1bn ($970mn) in 2022 from a record €2bn in 2021, EBRD President Odile Renaud-Basso has told Bloomberg.

The EBRD is the largest single-entity institutional investor in Turkey. Since 2009, it has invested €17bn in the country through 378 projects. Its €7bn outstanding portfolio in Turkey is the largest portfolio the EBRD has in terms of the 38 economies in which the development bank invests.

“We used to have access to the offshore lira market, and the regulations have made it impossible to access the local currency now,” Basso was quoted as saying.

Companies that do not have FX-denominated export revenues are affected the most as they are not qualified to obtain FX loans, she added.

For such companies, the EBRD provides lira loans and hedges its currency risks via the London offshore swap market.

Since 2018, when Turkey’s lira entered the first phase of its unprecedented collapse, the lira squeeze for foreigners has been followed by periodically booming lira costs on the London offshore swap market.

Turkish banks are informally ordered to cut the lira supply on the market to prevent foreign traders from shorting lira, particularly when the stress on the local currency is high.

In June, Turkey’s capital markets board (SPK) also ordered local banks to not market supranational bonds, namely lira bonds sold by foreign banks, to their customers. These papers are an alternative way to access lira.

30 TURKEY Country Report November 2022 www.intellinews.com