Page 36 - RusRPTAug23

P. 36

Public social spending will continue to support the economy – at least until the end of the 2024 election cycle. However, there is one important factor that could halt the slide of the economy into recession – this is the government’s expanded social spending. In their most recent communications on economic policy, President Putin and his Cabinet officials said that in their growth policies, they want to prioritize support for domestic demand. This means that government will continue to boost its spending on public wages and pensions: it already announced that in October 2023 the salaries of the military and security personnel will be increased followed by a similar move in January 2024 on the wages of other public employees. As the latest data suggests, real wages have already seen a massive rise of over 10% Y/y in April and the trend will likely continue in 2H23 and 1Q24, especially if one takes into account the start of a new political cycle in Russia (next presidential elections in Russia should take place in March 2024).

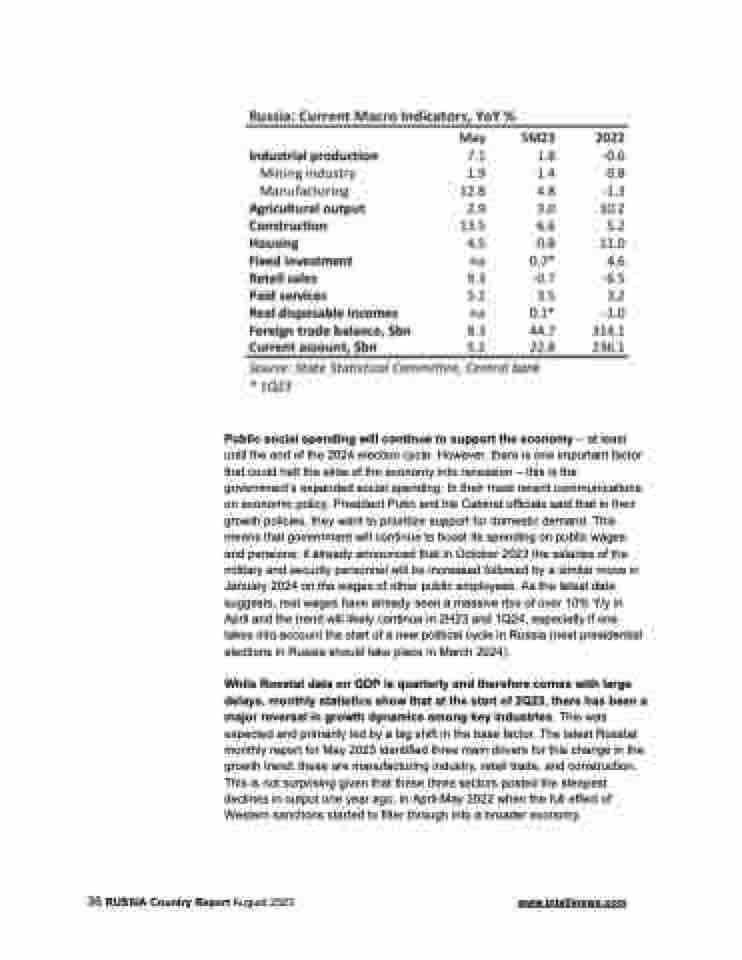

While Rosstat data on GDP is quarterly and therefore comes with large delays, monthly statistics show that at the start of 2Q23, there has been a major reversal in growth dynamics among key industries. This was expected and primarily led by a big shift in the base factor. The latest Rosstat monthly report for May 2023 identified three main drivers for this change in the growth trend: these are manufacturing industry, retail trade, and construction. This is not surprising given that these three sectors posted the steepest declines in output one year ago, in April-May 2022 when the full effect of Western sanctions started to filter through into a broader economy.

36 RUSSIA Country Report August 2023 www.intellinews.com