Page 74 - RusRPTAug23

P. 74

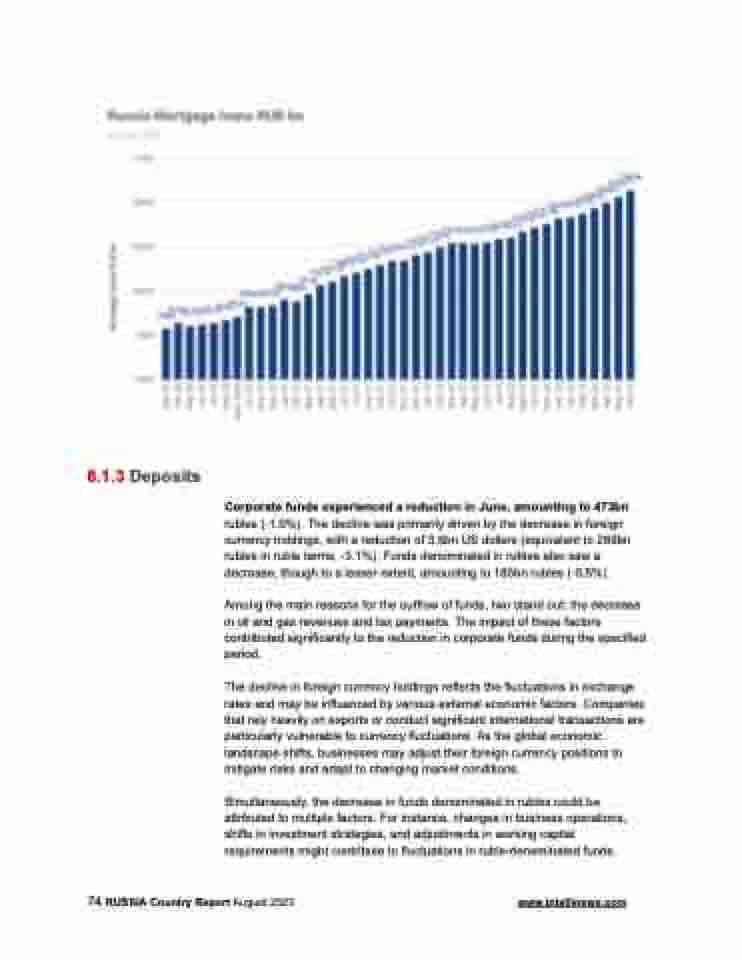

8.1.3 Deposits

Corporate funds experienced a reduction in June, amounting to 473bn

rubles (-1.0%). The decline was primarily driven by the decrease in foreign currency holdings, with a reduction of 3.6bn US dollars (equivalent to 289bn rubles in ruble terms, -3.1%). Funds denominated in rubles also saw a decrease, though to a lesser extent, amounting to 185bn rubles (-0.5%).

Among the main reasons for the outflow of funds, two stand out: the decrease in oil and gas revenues and tax payments. The impact of these factors contributed significantly to the reduction in corporate funds during the specified period.

The decline in foreign currency holdings reflects the fluctuations in exchange rates and may be influenced by various external economic factors. Companies that rely heavily on exports or conduct significant international transactions are particularly vulnerable to currency fluctuations. As the global economic landscape shifts, businesses may adjust their foreign currency positions to mitigate risks and adapt to changing market conditions.

Simultaneously, the decrease in funds denominated in rubles could be attributed to multiple factors. For instance, changes in business operations, shifts in investment strategies, and adjustments in working capital requirements might contribute to fluctuations in ruble-denominated funds.

74 RUSSIA Country Report August 2023 www.intellinews.com