Page 88 - bne IntelliNews Southeastern Europe Outlook 2025

P. 88

5.6 Real Economy – Moldova

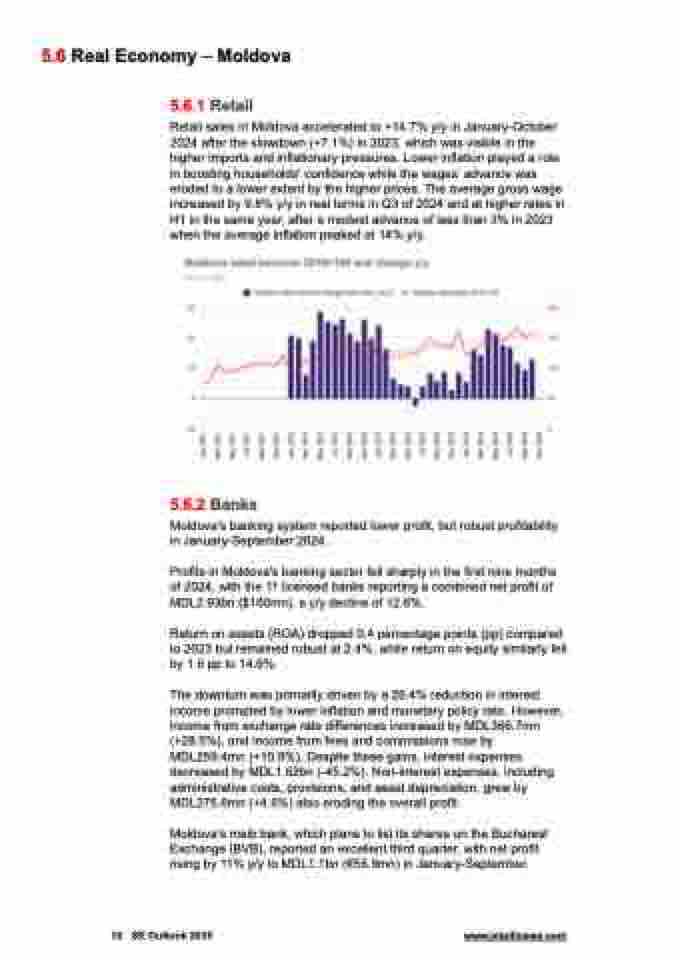

5.6.1 Retail

Retail sales in Moldova accelerated to +14.7% y/y in January-October 2024 after the slowdown (+7.1%) in 2023, which was visible in the higher imports and inflationary pressures. Lower inflation played a role in boosting households’ confidence while the wages’ advance was eroded to a lower extent by the higher prices. The average gross wage increased by 9.8% y/y in real terms in Q3 of 2024 and at higher rates in H1 in the same year, after a modest advance of less than 3% in 2023 when the average inflation peaked at 14% y/y.

5.6.2 Banks

Moldova’s banking system reported lower profit, but robust profitability

in January-September 2024.

Profits in Moldova's banking sector fell sharply in the first nine months of 2024, with the 11 licensed banks reporting a combined net profit of MDL2.93bn ($160mn), a y/y decline of 12.6%.

Return on assets (ROA) dropped 0.4 percentage points (pp) compared to 2023 but remained robust at 2.4%, while return on equity similarly fell by 1.6 pp to 14.6%.

The downturn was primarily driven by a 26.4% reduction in interest income prompted by lower inflation and monetary policy rate. However, income from exchange rate differences increased by MDL366.7mn (+28.5%), and income from fees and commissions rose by MDL259.4mn (+10.8%). Despite these gains, interest expenses decreased by MDL1.62bn (-45.2%). Non-interest expenses, including administrative costs, provisions, and asset depreciation, grew by MDL275.6mn (+4.6%) also eroding the overall profit.

Moldova’s maib bank, which plans to list its shares on the Bucharest Exchange (BVB), reported an excellent third quarter, with net profit rising by 11% y/y to MDL1.1bn (€56.9mn) in January-September.

88 SE Outlook 2025 www.intellinews.com