Page 9 - TURKRptDec22

P. 9

The FAO food price index declined for the seventh consecutive month to 135.9 points, up 6% y/y, in October from 136 in September (Record high: 159.7 in March).

As of November 25, Brent was up 15% y/y to $84 while Dutch TTF 1-month Natural Gas Futures contract was higher by 43% y/y to €125/MWh ($1.38/m3).

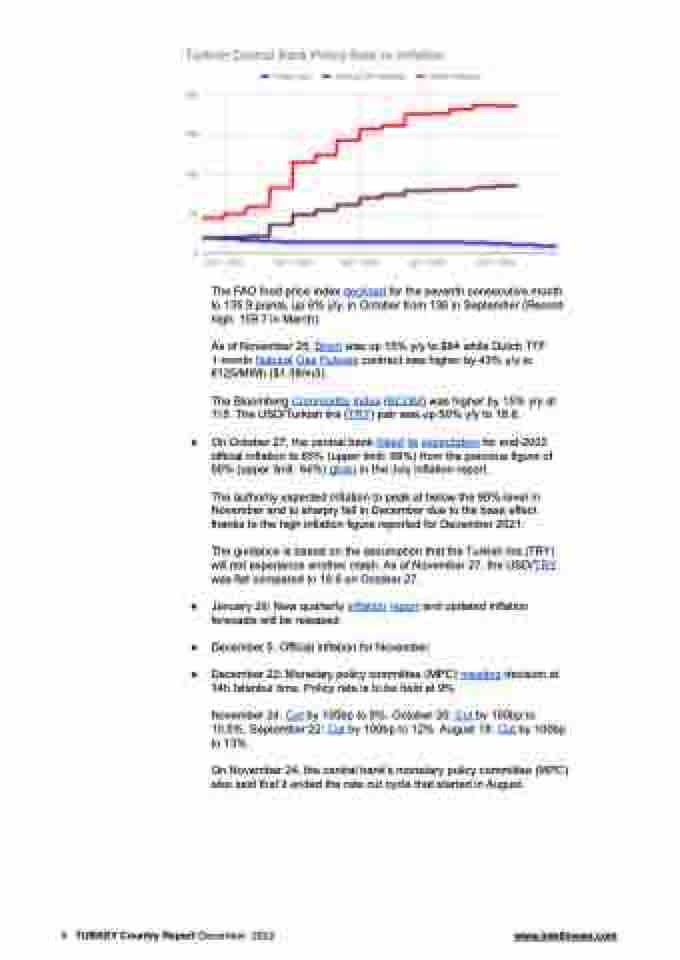

The Bloomberg Commodity Index (BCOM) was higher by 15% y/y at 115. The USD/Turkish lira (TRY) pair was up 50% y/y to 18.6.

● On October 27, the central bank hiked its expectation for end-2022 official inflation to 65% (upper limit: 68%) from the previous figure of 60% (upper limit: 64%) given in the July inflation report.

The authority expected inflation to peak at below the 90%-level in November and to sharply fall in December due to the base effect thanks to the high inflation figure reported for December 2021.

The guidance is based on the assumption that the Turkish lira (TRY) will not experience another crash. As of November 27, the USD/TRY was flat compared to 18.6 on October 27.

● January 26: New quarterly inflation report and updated inflation forecasts will be released.

● December 5: Official inflation for November.

● December 22: Monetary policy committee (MPC) meeting decision at 14h Istanbul time. Policy rate is to be held at 9%.

November 24: Cut by 150bp to 9%. October 20: Cut by 150bp to 10.5%. September 22: Cut by 100bp to 12%. August 18: Cut by 100bp to 13%.

On November 24, the central bank’s monetary policy committee (MPC) also said that it ended the rate cut cycle that started in August.

9 TURKEY Country Report December 2022 www.intellinews.com