Page 45 - GEORptJul22

P. 45

The bank expects strong GDP growth in 2022 at around 5.5%, citing "the resilience of the Georgian economy" amid the war in Ukraine. The recovery started in the 2Q21, reaching 28.9% growth in real GDP, and gradually slowing down to 8.8% in Q421. "Despite the adverse impact of the war in Ukraine, this growth momentum continued in the beginning of 2022, only partially driven by the low base effect a year ago," the bank said. According to preliminary estimates of the National Statistics Office of Georgia, the Georgian economy expanded by 14.4% y/y in Q1, with a solid increase of 10.6% y/y in March. Bank credit increased by 18% y/y by the end of 1Q22, compared to 18.2% by the end of 4Q21. In terms of segments, retail lending growth accelerated the most, increasing from 18% at the end of 4Q21 to 19.7% at the end of 1Q22. MSME (micro, small and medium-sized enterprise) lending also grew from 22.3% at the end of 1Q21 to 22.5%, while in the same period corporate lending slowed by 2.8 pp, amounting to 12.8%.

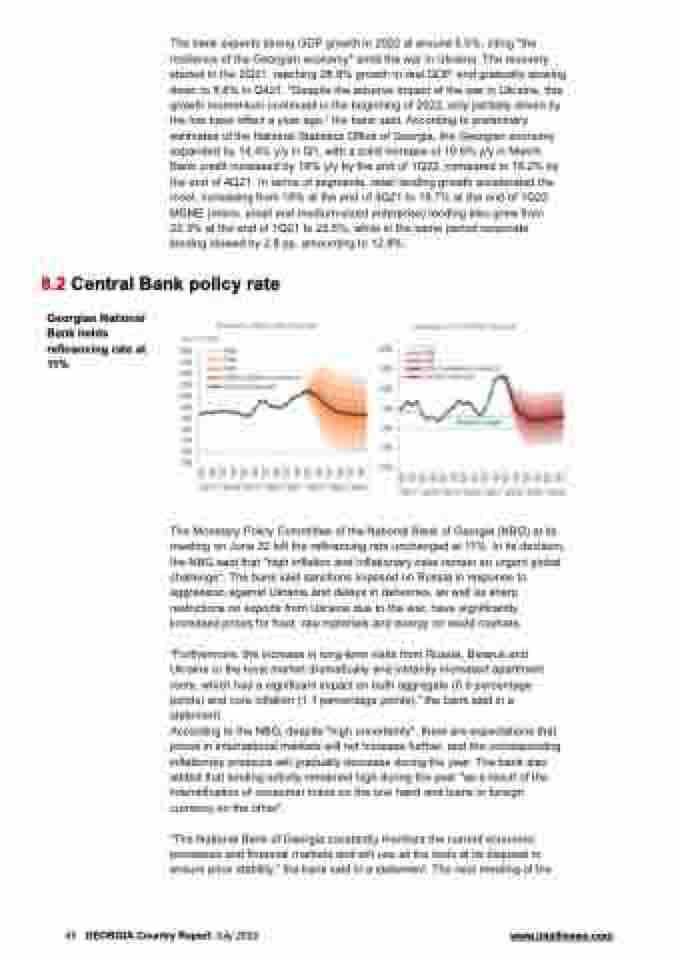

8.2 Central Bank policy rate

Georgian National Bank holds refinancing rate at 11%

The Monetary Policy Committee of the National Bank of Georgia (NBG) at its meeting on June 22 left the refinancing rate unchanged at 11%. In its decision, the NBG said that "high inflation and inflationary risks remain an urgent global challenge". The bank said sanctions imposed on Russia in response to aggression against Ukraine and delays in deliveries, as well as sharp restrictions on exports from Ukraine due to the war, have significantly increased prices for food, raw materials and energy on world markets.

“Furthermore, the increase in long-term visits from Russia, Belarus and Ukraine to the local market dramatically and instantly increased apartment rents, which had a significant impact on both aggregate (0.6 percentage points) and core inflation (1.1 percentage points),” the bank said in a statement.

According to the NBG, despite "high uncertainty", there are expectations that prices in international markets will not increase further, and the corresponding inflationary pressure will gradually decrease during the year. The bank also added that lending activity remained high during the year "as a result of the intensification of consumer loans on the one hand and loans in foreign currency on the other".

“The National Bank of Georgia constantly monitors the current economic processes and financial markets and will use all the tools at its disposal to ensure price stability,” the bank said in a statement. The next meeting of the

45 GEORGIA Country Report July 2022 www.intellinews.com