Page 54 - TURKRptOct22

P. 54

6.3.2 Fixed income - govt funding plans

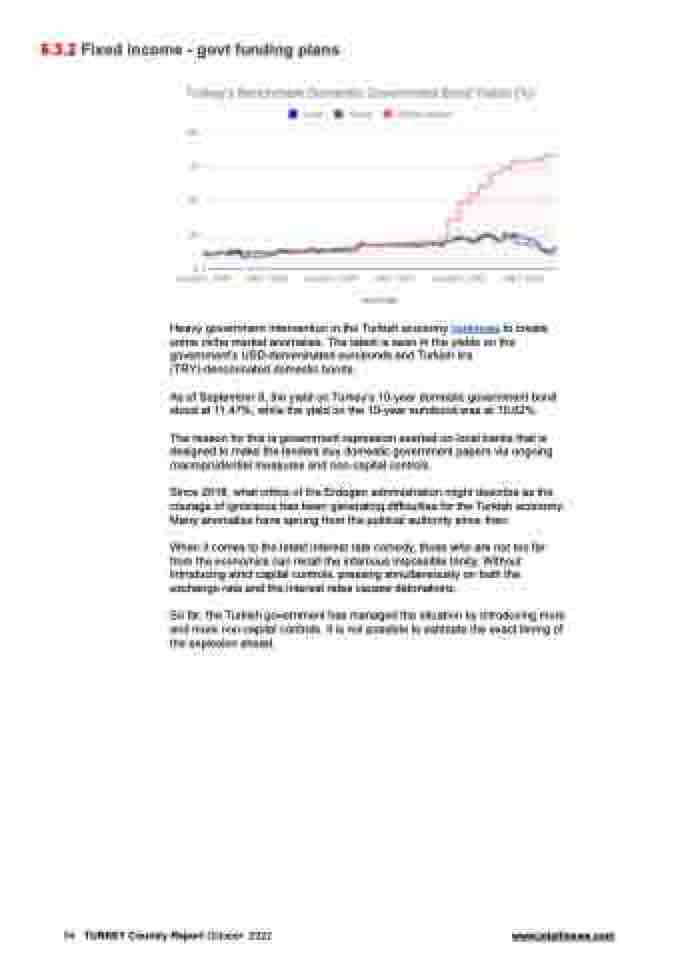

Heavy government intervention in the Turkish economy continues to create some niche market anomalies. The latest is seen in the yields on the government’s USD-denominated eurobonds and Turkish lira (TRY)-denominated domestic bonds.

As of September 8, the yield on Turkey’s 10-year domestic government bond stood at 11.47%, while the yield on the 10-year eurobond was at 10.62%.

The reason for this is government repression exerted on local banks that is designed to make the lenders buy domestic government papers via ongoing macroprudential measures and non-capital controls.

Since 2018, what critics of the Erdogan administration might describe as the courage of ignorance has been generating difficulties for the Turkish economy. Many anomalies have sprung from the political authority since then.

When it comes to the latest interest rate comedy, those who are not too far from the economics can recall the infamous impossible trinity. Without introducing strict capital controls, pressing simultaneously on both the exchange rate and the interest rates causes detonations.

So far, the Turkish government has managed the situation by introducing more and more non-capital controls. It is not possible to estimate the exact timing of the explosion ahead.

54 TURKEY Country Report October 2022 www.intellinews.com