Page 4 - NorthAm 32

P. 4

NorthAmOil COMMENTARY NorthAmOil

Devon picks up Eagle Ford acreage as M&A returns

Devon Energy will nearly double its Eagle Ford production in the first billion-dollar deal in the play since 2018.

UNITED STATES

WHAT:

Devon is buying Validus Energy in a $1.8bn deal that offers significant production upside.

WHY:

Validus added around 14,000 boepd of output from the acreage after acquiring it last year.

WHAT NEXT:

While it appears that the battle over valuations is likely to persist, Devon’s deal may herald the return of Eagle Ford M&A.

OKLAHOMA City-based Devon Energy announced plans this week to acquire Eagle Ford operator Validus Energy in what will be the basin’s largest deal for several years.

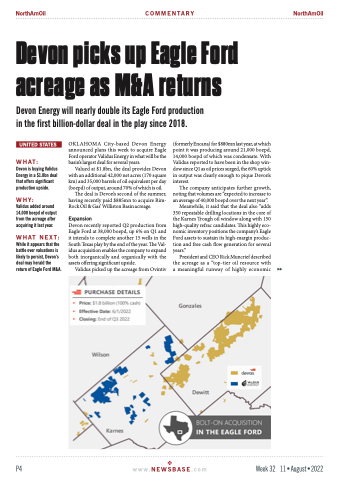

Valued at $1.8bn, the deal provides Devon with an additional 42,000 net acres (170 square km) and 35,000 barrels of oil equivalent per day (boepd) of output, around 70% of which is oil.

The deal is Devon’s second of the summer, having recently paid $885mn to acquire Rim- Rock Oil & Gas’ Williston Basin acreage.

Expansion

Devon recently reported Q2 production from Eagle Ford at 38,000 boepd, up 6% on Q1 and it intends to complete another 15 wells in the South Texas play by the end of the year. The Val- idus acquisition enables the company to expand both inorganically and organically with the assets offering significant upside.

Validus picked up the acreage from Ovintiv

(formerly Encana) for $880mn last year, at which point it was producing around 21,000 boepd, 14,000 boepd of which was condensate. With Validus reported to have been in the shop win- dow since Q1 as oil prices surged, the 60% uptick in output was clearly enough to pique Devon’s interest.

The company anticipates further growth, noting that volumes are “expected to increase to anaverageof40,000boepdoverthenextyear”.

Meanwhile, it said that the deal also “adds 350 repeatable drilling locations in the core of the Karnes Trough oil window along with 150 high-quality refrac candidates. This highly eco- nomic inventory positions the company’s Eagle Ford assets to sustain its high-margin produc- tion and free cash flow generation for several years.”

President and CEO Rick Muncrief described the acreage as a “top-tier oil resource with a meaningful runway of highly economic

P4

w w w . N E W S B A S E . c o m Week 32 11•August•2022