Page 51 - UKRRptAug22

P. 51

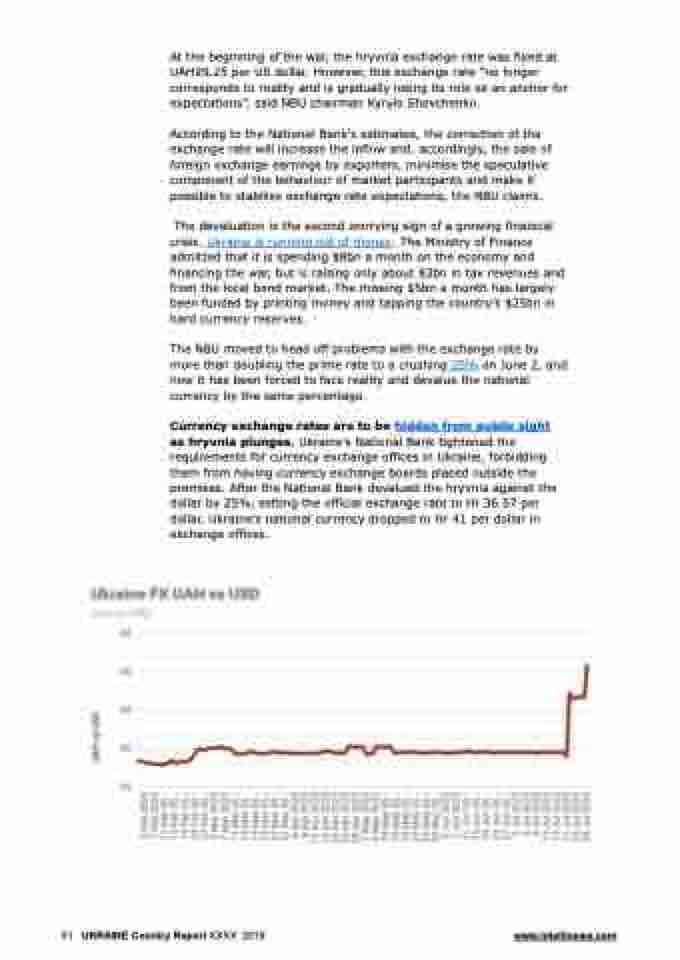

At the beginning of the war, the hryvnia exchange rate was fixed at UAH29.25 per US dollar. However, this exchange rate “no longer corresponds to reality and is gradually losing its role as an anchor for expectations”, said NBU chairman Kyrylo Shevchenko.

According to the National Bank's estimates, the correction of the exchange rate will increase the inflow and, accordingly, the sale of foreign exchange earnings by exporters, minimise the speculative component of the behaviour of market participants and make it possible to stabilise exchange rate expectations, the NBU claims.

The devaluation is the second worrying sign of a growing financial crisis. Ukraine is running out of money. The Ministry of Finance admitted that it is spending $8bn a month on the economy and financing the war, but is raising only about $3bn in tax revenues and from the local bond market. The missing $5bn a month has largely been funded by printing money and tapping the country’s $25bn in hard currency reserves.

The NBU moved to head off problems with the exchange rate by more than doubling the prime rate to a crushing 25% on June 2, and now it has been forced to face reality and devalue the national currency by the same percentage.

Currency exchange rates are to be hidden from public sight as hryvnia plunges. Ukraine’s National Bank tightened the requirements for currency exchange offices in Ukraine, forbidding them from having currency exchange boards placed outside the premises. After the National Bank devalued the hryvnia against the dollar by 25%, setting the official exchange rate to Hr 36.57 per dollar, Ukraine's national currency dropped to Hr 41 per dollar in exchange offices.

51 UKRAINE Country Report XXXX 2018 www.intellinews.com