Page 50 - UKRRptJun22

P. 50

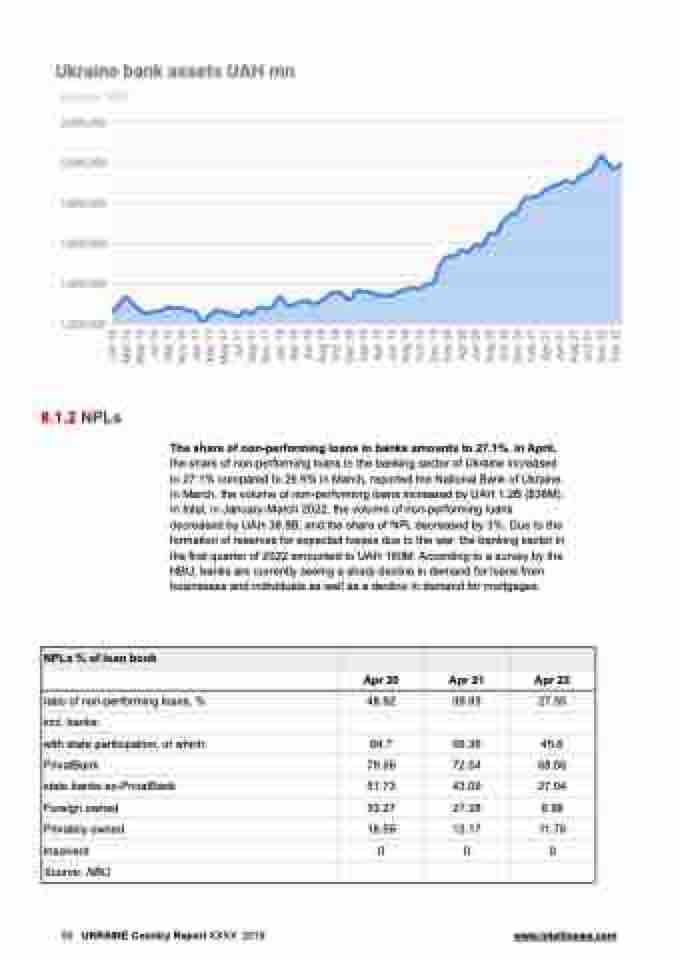

8.1.2 NPLs

The share of non-performing loans in banks amounts to 27.1%. In April,

the share of non-performing loans in the banking sector of Ukraine increased to 27.1% compared to 26.6% in March, reported the National Bank of Ukraine. In March, the volume of non-performing loans increased by UAH 1.2B ($38M). In total, in January-March 2022, the volume of non-performing loans decreased by UAH 38.9B, and the share of NPL decreased by 3%. Due to the formation of reserves for expected losses due to the war, the banking sector in the first quarter of 2022 amounted to UAH 160M. According to a survey by the NBU, banks are currently seeing a sharp decline in demand for loans from businesses and individuals as well as a decline in demand for mortgages.

NPLs % of loan book

Apr 20

Apr 21

Apr 22

ratio of non-performing loans, %

48.92

39.93

27.35

incl. banks:

with state participation, of which:

64.7

56.36

45.6

PrivatBank

78.66

72.54

68.06

state banks ex-PrivatBank

51.73

43.09

27.04

Foreign owned

33.27

27.28

6.98

Privately owned

18.59

13.17

11.78

Insolvent

0

0

0

Source: NBU

50 UKRAINE Country Report XXXX 2018 www.intellinews.com