Page 150 - RusRPTAug24

P. 150

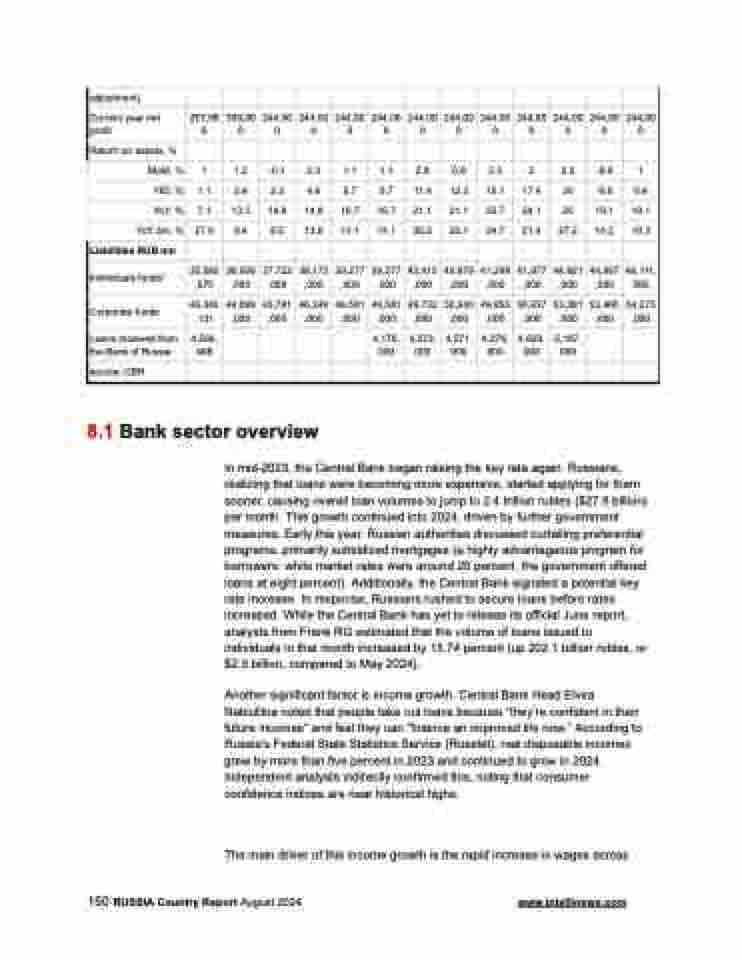

adjustment)

Current year net profit

257,98 6

330,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

244,00 0

Return on assets, %

MoM, %

1

1.2

-0.1

2.3

1.1

1.1

2.8

0.8

2.5

2

2.2

-0.6

1

YtD, %

1.1

2.4

2.3

4.6

5.7

5.7

11.4

12.3

15.1

17.4

20

-0.6

0.4

YoY, %

7.1

13.5

14.8

14.8

16.7

16.7

21.1

21.1

22.7

24.1

20

19.1

19.1

YoY 3m, %

27.6

9.4

8.5

13.6

13.1

13.1

26.2

25.1

24.7

21.4

27.2

14.2

10.3

Liabilities RUB mn

Individuals funds*

35,582 ,075

36,956 ,000

37,722 ,000

38,173 ,000

39,277 ,000

39,277 ,000

40,415 ,000

40,879 ,000

41,298 ,000

41,977 ,000

44,921 ,000

44,867 ,000

46,111, 000

Corporate funds

46,345 ,131

46,089 ,000

45,781 ,000

46,349 ,000

46,581 ,000

46,581 ,000

49,732 ,000

50,240 ,000

49,855 ,000

50,637 ,000

53,381 ,000

53,465 ,000

54,273 ,000

Loans received from the Bank of Russia

4,566, 408

4,176, 000

4,273, 000

4,571, 000

4,276, 000

4,620, 000

5,167, 000

source: CBR

8.1 Bank sector overview

In mid-2023, the Central Bank began raising the key rate again. Russians, realizing that loans were becoming more expensive, started applying for them sooner, causing overall loan volumes to jump to 2.4 trillion rubles ($27.8 billion) per month. This growth continued into 2024, driven by further government measures. Early this year, Russian authorities discussed curtailing preferential programs, primarily subsidized mortgages (a highly advantageous program for borrowers: while market rates were around 20 percent, the government offered loans at eight percent). Additionally, the Central Bank signaled a potential key rate increase. In response, Russians rushed to secure loans before rates increased. While the Central Bank has yet to release its official June report, analysts from Frank RG estimated that the volume of loans issued to individuals in that month increased by 13.74 percent (up 202.1 billion rubles, or $2.3 billion, compared to May 2024).

Another significant factor is income growth. Central Bank Head Elvira Nabiullina noted that people take out loans because “they’re confident in their future incomes” and feel they can “finance an improved life now.” According to Russia’s Federal State Statistics Service (Rosstat), real disposable incomes grew by more than five percent in 2023 and continued to grow in 2024. Independent analysts indirectly confirmed this, noting that consumer confidence indices are near historical highs.

The main driver of this income growth is the rapid increase in wages across

150 RUSSIA Country Report August 2024 www.intellinews.com