Page 116 - RusRPTJul24

P. 116

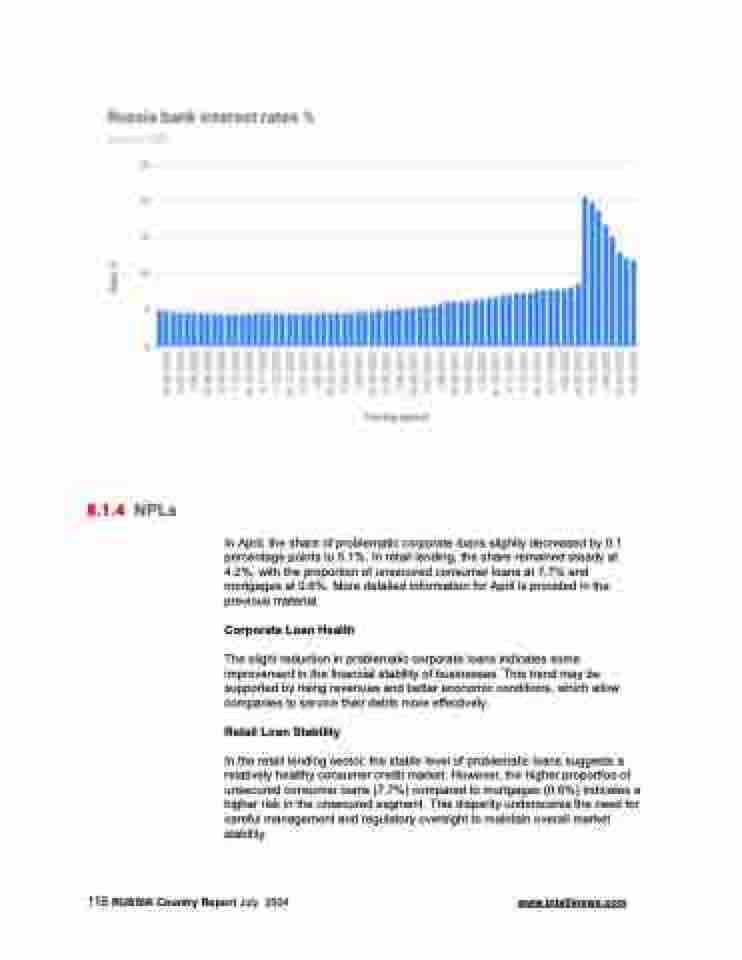

8.1.4 NPLs

In April, the share of problematic corporate loans slightly decreased by 0.1 percentage points to 5.1%. In retail lending, the share remained steady at 4.2%, with the proportion of unsecured consumer loans at 7.7% and mortgages at 0.6%. More detailed information for April is provided in the previous material.

Corporate Loan Health

The slight reduction in problematic corporate loans indicates some improvement in the financial stability of businesses. This trend may be supported by rising revenues and better economic conditions, which allow companies to service their debts more effectively.

Retail Loan Stability

In the retail lending sector, the stable level of problematic loans suggests a relatively healthy consumer credit market. However, the higher proportion of unsecured consumer loans (7.7%) compared to mortgages (0.6%) indicates a higher risk in the unsecured segment. This disparity underscores the need for careful management and regulatory oversight to maintain overall market stability.

116 RUSSIA Country Report July 2024 www.intellinews.com