Page 119 - RusRPTJul24

P. 119

federal government (FG) funds and 0.6 trillion rubles in funds from regional governments.

Tax Revenue Influence

The influx of government funds was primarily driven by tax revenues for April and May. The tax period, initially set for the end of April, was shifted to early May, resulting in the deposited funds being placed by the FG in May.

Central Bank Borrowing

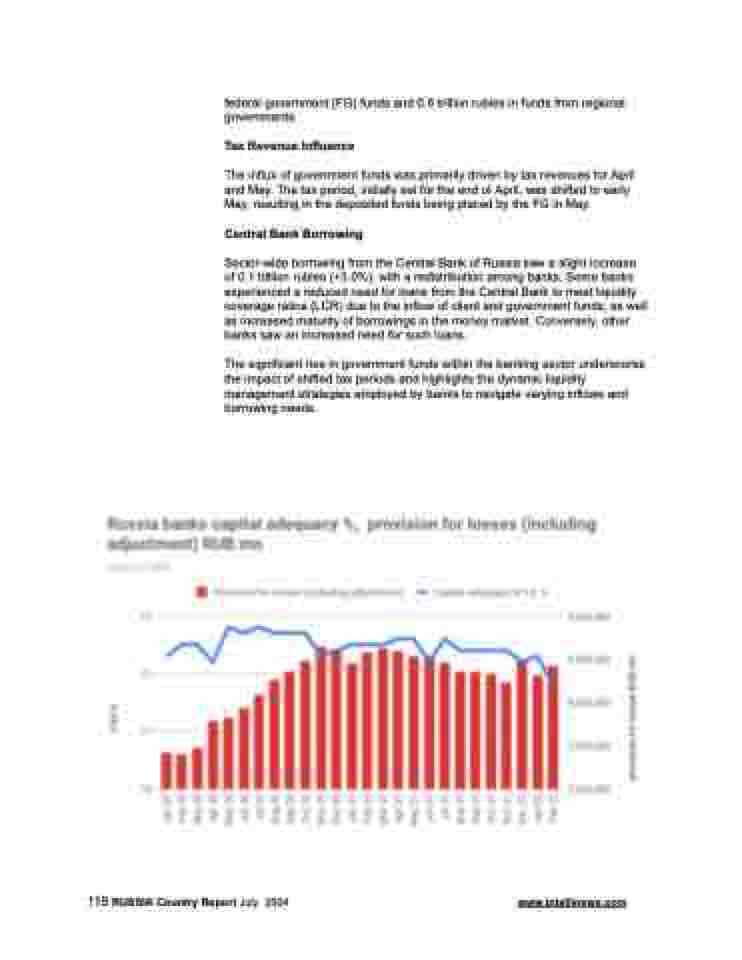

Sector-wide borrowing from the Central Bank of Russia saw a slight increase of 0.1 trillion rubles (+3.0%), with a redistribution among banks. Some banks experienced a reduced need for loans from the Central Bank to meet liquidity coverage ratios (LCR) due to the inflow of client and government funds, as well as increased maturity of borrowings in the money market. Conversely, other banks saw an increased need for such loans.

The significant rise in government funds within the banking sector underscores the impact of shifted tax periods and highlights the dynamic liquidity management strategies employed by banks to navigate varying inflows and borrowing needs.

119 RUSSIA Country Report July 2024 www.intellinews.com