Page 12 - RusRPTJul24

P. 12

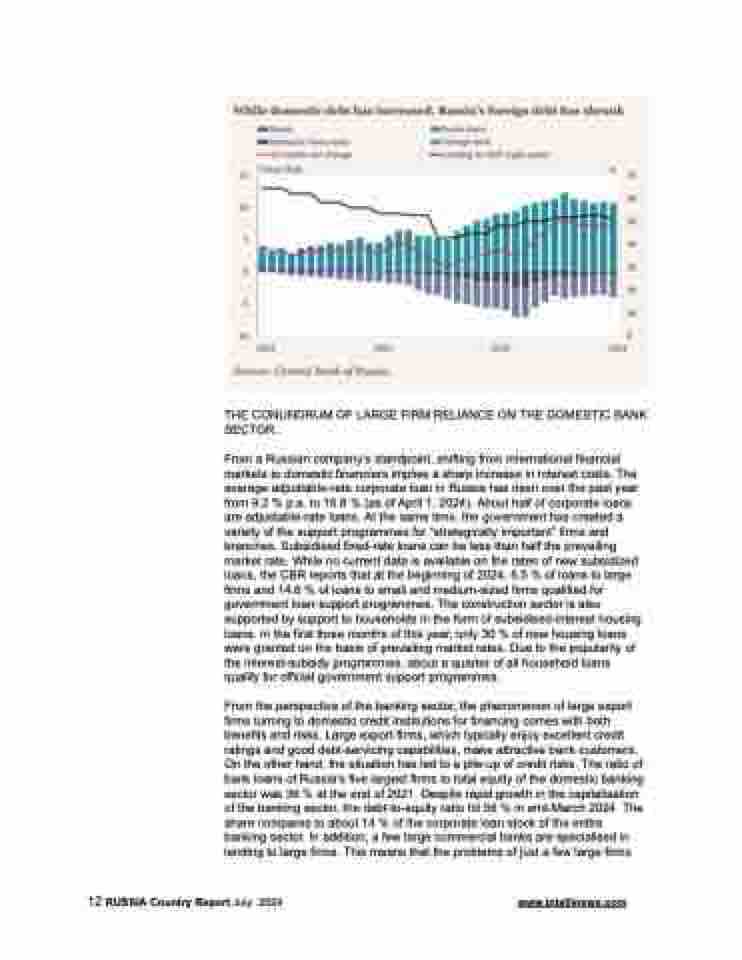

THE CONUNDRUM OF LARGE FIRM RELIANCE ON THE DOMESTIC BANK SECTOR .

From a Russian company’s standpoint, shifting from international financial markets to domestic financiers implies a sharp increase in interest costs. The average adjustable-rate corporate loan in Russia has risen over the past year from 9.2 % p.a. to 16.8 % (as of April 1, 2024). About half of corporate loans are adjustable-rate loans. At the same time, the government has created a variety of the support programmes for “strategically important” firms and branches. Subsidised fixed-rate loans can be less than half the prevailing market rate. While no current data is available on the rates of new subsidized loans, the CBR reports that at the beginning of 2024, 6.5 % of loans to large firms and 14.6 % of loans to small and medium-sized firms qualified for government loan-support programmes. The construction sector is also supported by support to households in the form of subsidised-interest housing loans. In the first three months of this year, only 30 % of new housing loans were granted on the basis of prevailing market rates. Due to the popularity of the interest-subsidy programmes, about a quarter of all household loans qualify for official government support programmes.

From the perspective of the banking sector, the phenomenon of large export firms turning to domestic credit institutions for financing comes with both benefits and risks. Large export firms, which typically enjoy excellent credit ratings and good debt-servicing capabilities, make attractive bank customers. On the other hand, the situation has led to a pile-up of credit risks. The ratio of bank loans of Russia’s five largest firms to total equity of the domestic banking sector was 36 % at the end of 2021. Despite rapid growth in the capitalisation of the banking sector, the debt-to-equity ratio hit 56 % in end-March 2024. The share compares to about 14 % of the corporate loan stock of the entire banking sector. In addition, a few large commercial banks are specialised in lending to large firms. This means that the problems of just a few large firms

12 RUSSIA Country Report July 2024 www.intellinews.com