Page 142 - RusRPTJul24

P. 142

● Prices & demand

Slowing demand growth and surging supply are set to drive up oil market surplus. Growth in the world’s demand for oil is expected to slow in the coming years as energy transitions advance. At the same time, global oil production is set to ramp up – easing market strains and pushing spare capacity towards levels unseen outside of the Covid crisis, according to IEA new oil market outlook.

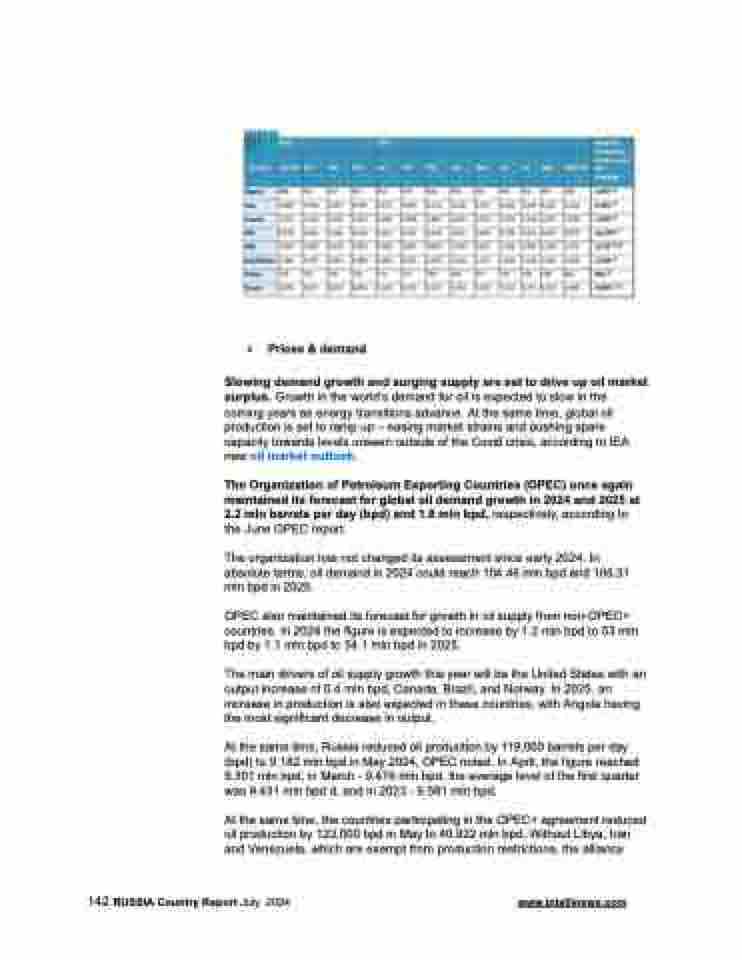

The Organization of Petroleum Exporting Countries (OPEC) once again maintained its forecast for global oil demand growth in 2024 and 2025 at 2.2 mln barrels per day (bpd) and 1.8 mln bpd, respectively, according to the June OPEC report.

The organization has not changed its assessment since early 2024. In absolute terms, oil demand in 2024 could reach 104.46 mln bpd and 106.31 mln bpd in 2025.

OPEC also maintained its forecast for growth in oil supply from non-OPEC+ countries. In 2024 the figure is expected to increase by 1.2 mln bpd to 53 mln bpd by 1.1 mln bpd to 54.1 mln bpd in 2025.

The main drivers of oil supply growth this year will be the United States with an output increase of 0.4 mln bpd, Canada, Brazil, and Norway. In 2025, an increase in production is also expected in these countries, with Angola having the most significant decrease in output.

At the same time, Russia reduced oil production by 119,000 barrels per day (bpd) to 9.182 mln bpd in May 2024, OPEC noted. In April, the figure reached 9.301 mln bpd, in March - 9.476 mln bpd, the average level of the first quarter was 9.431 mln bpd d, and in 2023 - 9.581 mln bpd.

At the same time, the countries participating in the OPEC+ agreement reduced oil production by 123,000 bpd in May to 40.922 mln bpd. Without Libya, Iran and Venezuela, which are exempt from production restrictions, the alliance

142 RUSSIA Country Report July 2024 www.intellinews.com