Page 114 - RusRPTJan23

P. 114

8.3.3 ECM news

Russian kick-sharing service Whoosh is maintaining will hold its previously announced initial public offering (IPO) on the Moscow Exchange (MOEX) at an offering price of RUB185 per ordinary share, making a target capitalisation of RUB18.5bn ($294mn), RBC business portal reported citing the company’s press release. As followed by bne IntelliNews, prior to the military invasion of Ukraine the Russian equity market was going through an IPO boom, in part fuelled by the retail investment revolution. But as the barrage of Western sanctions cut off Russian issuers from the global financial markets, the offerings have dropped dramatically. In October the secondary public offering (SPO) of Russian cyber and information security solutions developer Positive Technologies failed to attract sufficient demand from investors. But Whoosh maintains its IPO plans, albeit at the lower placement range of the RUB185-RUB225 per share offering price guidance previously released by the company.

Polymetal has bought back an 8.2% stake of voting shares under a program of swapping electronic shares for documentary ones, the company said in a statement on December 12. In October, Polymetal’s shareholders approved conversion for some investors affected by the EU sanctions on the National Settlement Depository. The company said that the shares it bought would not represent voting rights and would be held on the treasury accounts of the company. Polymetal will annul the shares if sanctions are eased.

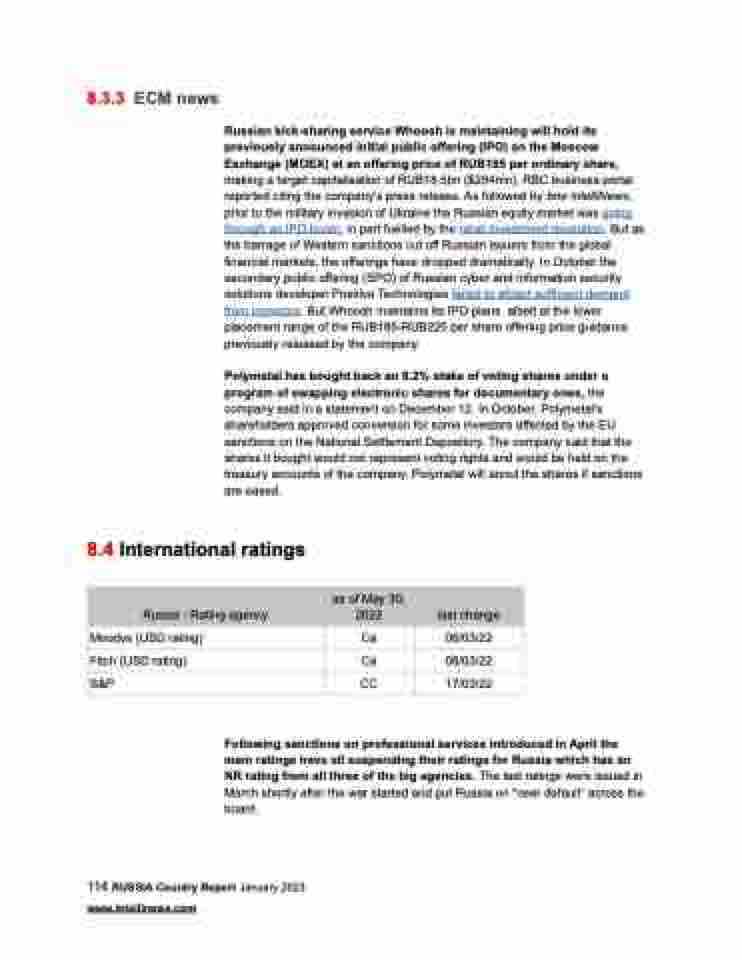

8.4 International ratings

Russia - Rating agency

as of May 30, 2022

last change

Moodys (USD rating)

Ca

06/03/22

Fitch (USD rating)

Ca

08/03/22

S&P

CC

17/03/22

Following sanctions on professional services introduced in April the main ratings have all suspending their ratings for Russia which has an NR rating from all three of the big agencies. The last ratings were issued in March shortly after the war started and put Russia on “near default” across the board.

114 RUSSIA Country Report January 2023 www.intellinews.com