Page 46 - RusRPTJan23

P. 46

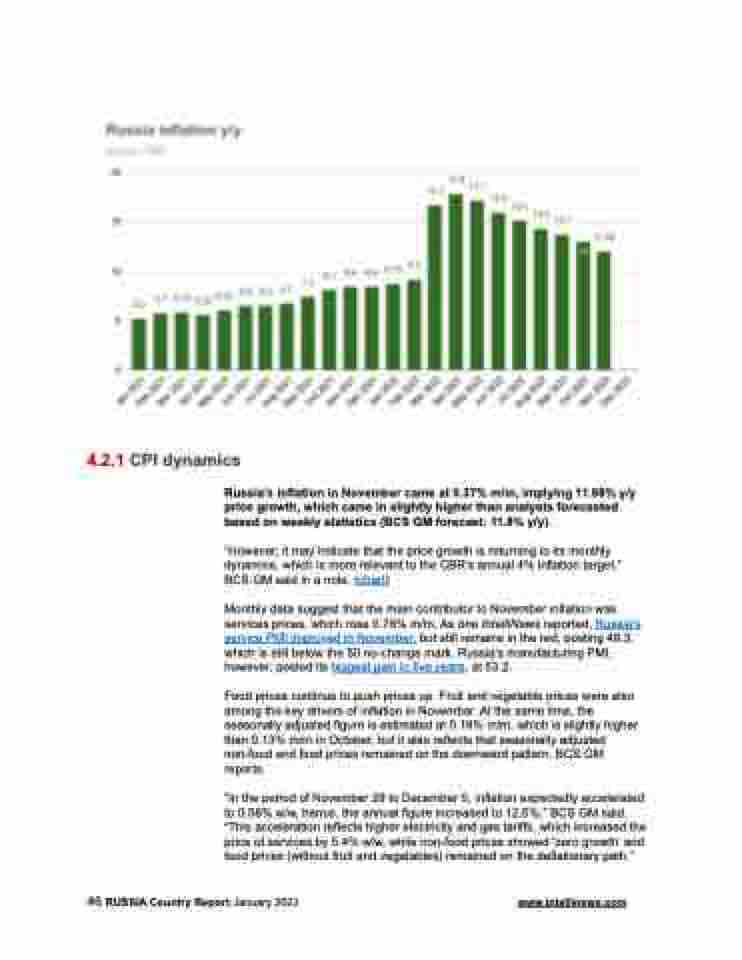

4.2.1 CPI dynamics

Russia’s inflation in November came at 0.37% m/m, implying 11.98% y/y price growth, which came in slightly higher than analysts forecasted based on weekly statistics (BCS GM forecast: 11.8% y/y).

“However, it may indicate that the price growth is returning to its monthly dynamics, which is more relevant to the CBR’s annual 4% inflation target,” BCS GM said in a note. (chart)

Monthly data suggest that the main contributor to November inflation was services prices, which rose 0.76% m/m. As bne IntelliNews reported, Russia’s service PMI improved in November, but still remains in the red, posting 48.3, which is still below the 50 no-change mark. Russia’s manufacturing PMI, however, posted its biggest gain in five years, at 53.2.

Food prices continue to push prices up. Fruit and vegetable prices were also among the key drivers of inflation in November. At the same time, the seasonally adjusted figure is estimated at 0.19% m/m, which is slightly higher than 0.13% m/m in October, but it also reflects that seasonally adjusted non-food and food prices remained on the downward pattern, BCS GM reports.

“In the period of November 29 to December 5, inflation expectedly accelerated to 0.58% w/w, hence, the annual figure increased to 12.5%,” BCS GM said. “This acceleration reflects higher electricity and gas tariffs, which increased the price of services by 5.4% w/w, while non-food prices showed ‘zero growth’ and food prices (without fruit and vegetables) remained on the deflationary path.”

46 RUSSIA Country Report January 2023 www.intellinews.com