Page 85 - RusRPTJan23

P. 85

cut-off price, but to fix the income constant - 8 trillion rubles, since the cost of Russian oil and the volume of production can fluctuate significantly. “Everything that is higher will go to the “box,” explained Finance Minister Anton SiluaNovember

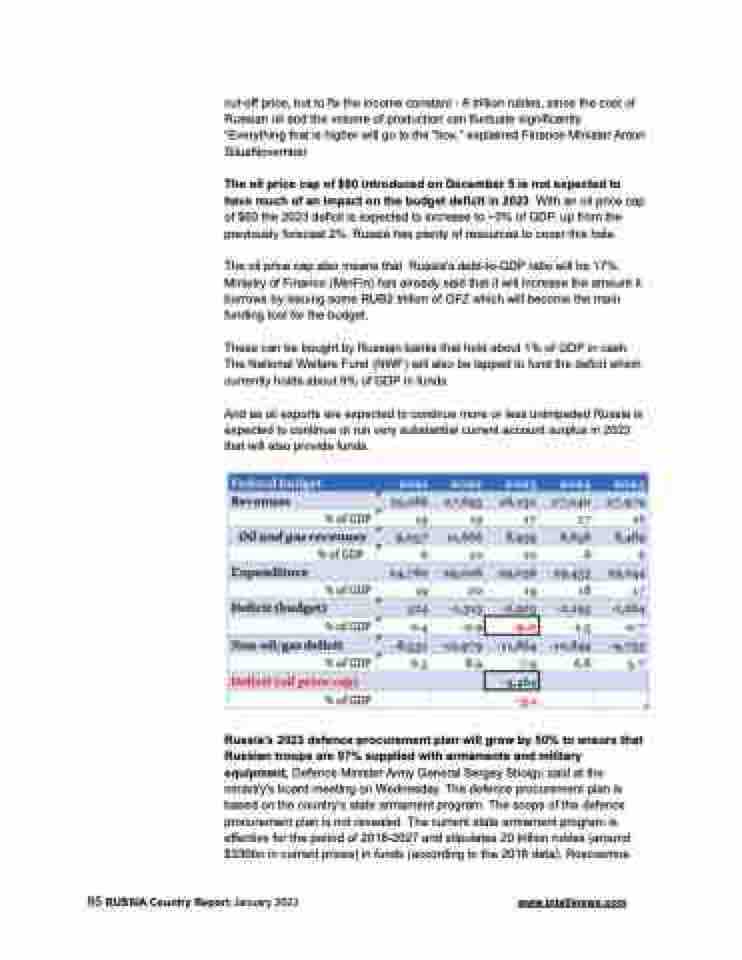

The oil price cap of $60 introduced on December 5 is not expected to have much of an impact on the budget deficit in 2023. With an oil price cap of $60 the 2023 deficit is expected to increase to ~3% of GDP, up from the previously forecast 2%. Russia has plenty of resources to cover this hole.

The oil price cap also means that Russia's debt-to-GDP ratio will be 17%. Ministry of Finance (MinFin) has already said that it will increase the amount it borrows by issuing some RUB2 trillion of OFZ which will become the main funding tool for the budget.

These can be bought by Russian banks that hold about 1% of GDP in cash. The National Welfare Fund (NWF) will also be tapped to fund the deficit which currently holds about 9% of GDP in funds.

And as oil exports are expected to continue more or less unimpeded Russia is expected to continue ot run very substantial current account surplus in 2023 that will also provide funds.

Russia’s 2023 defence procurement plan will grow by 50% to ensure that Russian troops are 97% supplied with armaments and military equipment, Defence Minister Army General Sergey Shoigu said at the ministry’s board meeting on Wednesday. The defence procurement plan is based on the country’s state armament program. The scope of the defence procurement plan is not revealed. The current state armament program is effective for the period of 2018-2027 and stipulates 20 trillion rubles (around $330bn in current prices) in funds (according to the 2018 data). Roscosmos

85 RUSSIA Country Report January 2023 www.intellinews.com