Page 159 - RusRPTApr23

P. 159

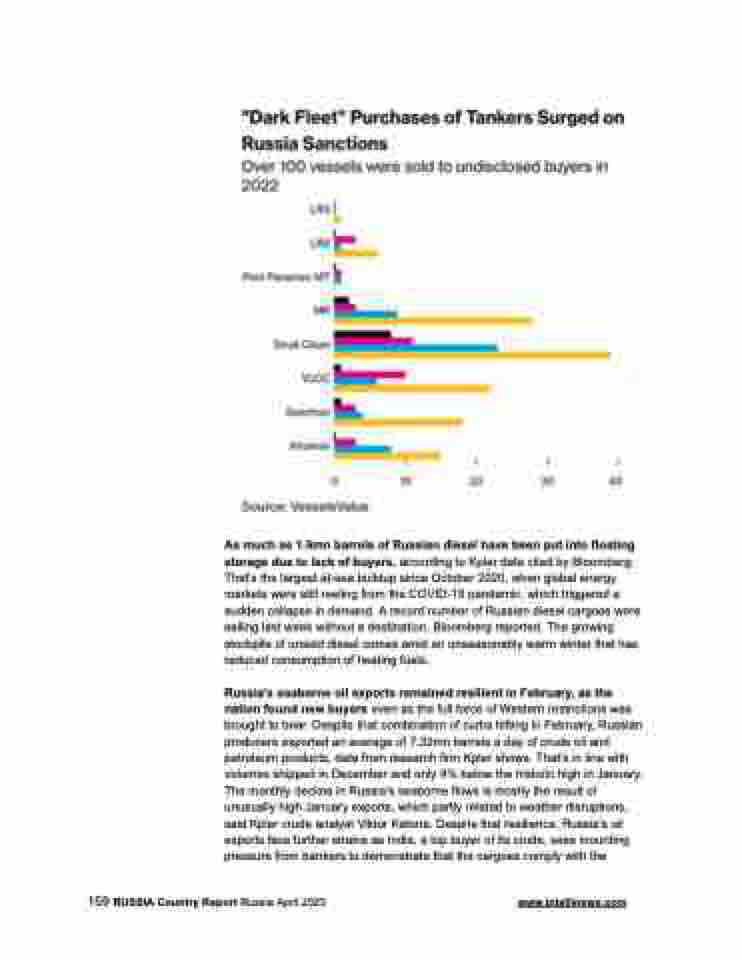

As much as 1.9mn barrels of Russian diesel have been put into floating storage due to lack of buyers, according to Kpler data cited by Bloomberg. That's the largest at-sea buildup since October 2020, when global energy markets were still reeling from the COVID-19 pandemic, which triggered a sudden collapse in demand. A record number of Russian diesel cargoes were sailing last week without a destination, Bloomberg reported. The growing stockpile of unsold diesel comes amid an unseasonably warm winter that has reduced consumption of heating fuels.

Russia’s seaborne oil exports remained resilient in February, as the nation found new buyers even as the full force of Western restrictions was brought to bear. Despite that combination of curbs hitting in February, Russian producers exported an average of 7.32mn barrels a day of crude oil and petroleum products, data from research firm Kpler shows. That’s in line with volumes shipped in December and only 9% below the historic high in January. The monthly decline in Russia’s seaborne flows is mostly the result of unusually high January exports, which partly related to weather disruptions, said Kpler crude analyst Viktor Katona. Despite that resilience, Russia’s oil exports face further strains as India, a top buyer of its crude, sees mounting pressure from bankers to demonstrate that the cargoes comply with the

159 RUSSIA Country Report Russia April 2023 www.intellinews.com