Page 71 - RusRPTApr23

P. 71

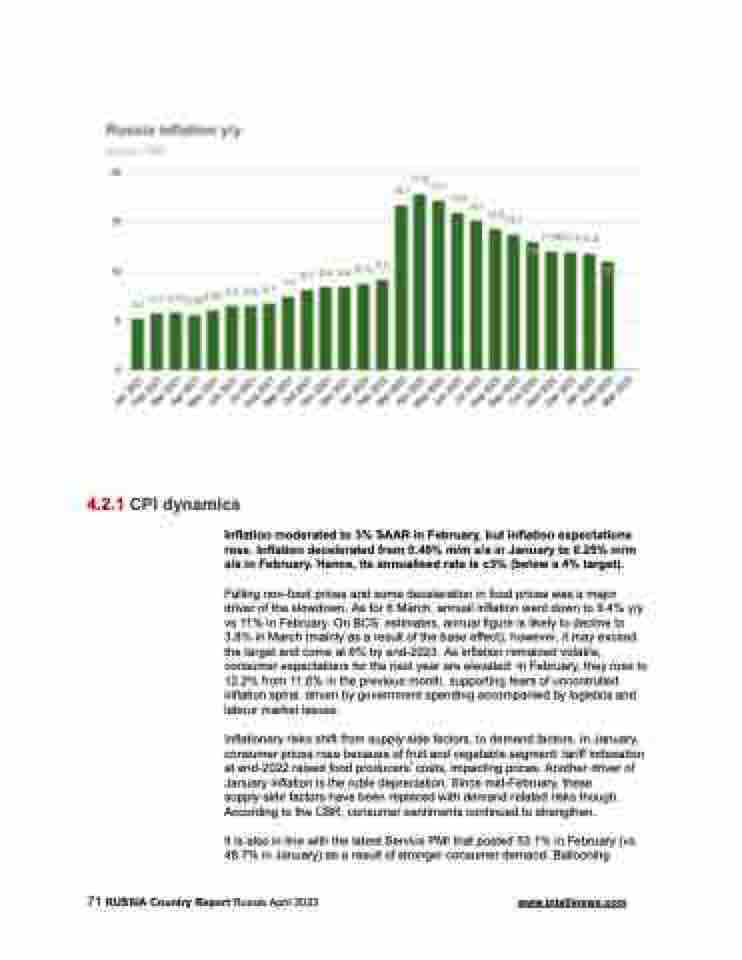

4.2.1 CPI dynamics

Inflation moderated to 3% SAAR in February, but inflation expectations rose. Inflation decelerated from 0.49% m/m s/a in January to 0.25% m/m s/a in February. Hence, its annualised rate is c3% (below a 4% target).

Falling non-food prices and some deceleration in food prices was a major driver of the slowdown. As for 6 March, annual inflation went down to 9.4% y/y vs 11% in February. On BCS estimates, annual figure is likely to decline to 3.8% in March (mainly as a result of the base effect), however, it may exceed the target and come at 6% by end-2023. As inflation remained volatile, consumer expectations for the next year are elevated: in February, they rose to 12.2% from 11.6% in the previous month, supporting fears of uncontrolled inflation spiral, driven by government spending accompanied by logistics and labour market issues.

Inflationary risks shift from supply-side factors, to demand factors. In January, consumer prices rose because of fruit and vegetable segment: tariff indexation at end-2022 raised food producers’ costs, impacting prices. Another driver of January inflation is the ruble depreciation. Since mid-February, these supply-side factors have been replaced with demand related risks though. According to the CBR, consumer sentiments continued to strengthen.

It is also in line with the latest Service PMI that posted 53.1% in February (vs 48.7% in January) as a result of stronger consumer demand. Ballooning

71 RUSSIA Country Report Russia April 2023 www.intellinews.com