Page 77 - bneMag Dec22

P. 77

bne December 2022 Eurasia I 77

Nurmuratov argues that inflation tar- geting cannot be done to the exclusion of the wider reforms that are going on in the economy and has integrated his plans with those of other ministries, especially the Ministry of Finance, as there is a fiscal component to inflation as well as a monetary one.

Given the extreme non-monetary nature of the current inflation surge, which is driven as much by food, energy and supply chain disruptions, Deputy Finance Minister Odilbek Isakov said in a separate session that his ministry was conscious of its role in the battle to keep inflation under control by using fiscal means as well as monetary.

“It is not possible to completely imple- ment effective inflation targeting during the reform process, so our efforts must be integrated into the reform process to establish a market competition environ- ment so that the tools we need can be made effective,” Nurmuratov said.

The CBU plans have progressed steadily, starting with the liberalisation of foreign exchange in 2018. Then the new legal framework for the operation of the central bank, including the guarantee of its independence, the monetary and payments systems were established in 2019-2020. The central bank then began to seriously target inflation in 2020, but the effort has been knocked sideways by the polycrisis that began the same year with the appearance of the coronavirus.

“We introduced an interim inflation target of 10% and [had] hoped to end the year with inflation at 8%, but while we were hoping to reach our initial 5% inflation target this year that deadline has now been pushed out to 2024,” Nurmuratov said.

Like the other central bank governors, Nurmuratov is conscious of the need to strike a balance between controlling inflation and at the same time promot- ing growth.

“If we can bring inflation down then the quality of life in the country will improve and that will also improve the growth of the economy,” Nurmuratov

said. “But this is heavily dependent on the success of structural reforms that are being carried out now.”

Kazakhstan battle not over

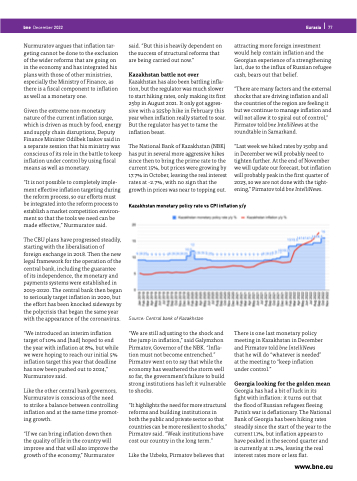

Kazakhstan has also been battling infla- tion, but the regulator was much slower to start hiking rates, only making its first 25bp in August 2021. It only got aggres- sive with a 325bp hike in February this year when inflation really started to soar. But the regulator has yet to tame the inflation beast.

The National Bank of Kazakhstan (NBK) has put in several more aggressive hikes since then to bring the prime rate to the current 15%, but prices were growing by 17.7% in October, leaving the real interest rates at -2.7%, with no sign that the growth in prices was near to topping out.

attracting more foreign investment would help contain inflation and the Georgian experience of a strengthening lari, due to the influx of Russian refugee cash, bears out that belief.

“There are many factors and the external shocks that are driving inflation and all the countries of the region are feeling it but we continue to manage inflation and will not allow it to spiral out of control,” Pirmatov told bne IntelliNews at the roundtable in Samarkand.

“Last week we hiked rates by 150bp and in December we will probably need to tighten further. At the end of November we will update our forecast, but inflation will probably peak in the first quarter of 2023, so we are not done with the tight- ening,” Pirmatov told bne IntelliNews.

Kazakhstan monetary policy rate vs CPI inflation y/y

Source: Central bank of Kazakhstan

“We are still adjusting to the shock and the jump in inflation,” said Galymzhon Pirmatov, Governor of the NBK. “Infla- tion must not become entrenched.” Pirmatov went on to say that while the economy has weathered the storm well so far, the government’s failure to build strong institutions has left it vulnerable to shocks.

“It highlights the need for more structural reforms and building institutions in both the public and private sector so that countries can be more resilient to shocks,” Pirmatov said. “Weak institutions have cost our country in the long term.”

Like the Uzbeks, Pirmatov believes that

There is one last monetary policy meeting in Kazakhstan in December and Pirmatov told bne IntelliNews that he will do “whatever is needed” at the meeting to “keep inflation under control.”

Georgia looking for the golden mean

Georgia has had a bit of luck in its

fight with inflation: it turns out that the flood of Russian refugees fleeing Putin’s war is deflationary. The National Bank of Georgia has been hiking rates steadily since the start of the year to the current 11%, but inflation appears to have peaked in the second quarter and is currently at 11.2%, leaving the real interest rates more or less flat.

www.bne.eu