Page 59 - bne IntelliNews SE Outlook Regions 2024

P. 59

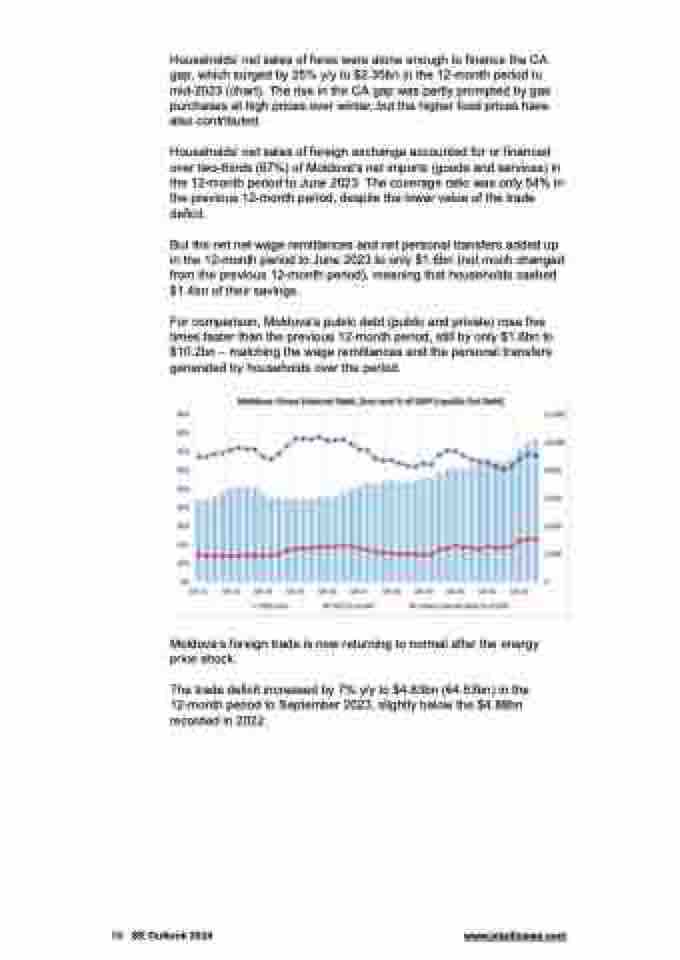

Households’ net sales of forex were alone enough to finance the CA gap, which surged by 25% y/y to $2.35bn in the 12-month period to mid-2023 (chart). The rise in the CA gap was partly prompted by gas purchases at high prices over winter, but the higher food prices have also contributed.

Households’ net sales of foreign exchange accounted for or financed over two-thirds (67%) of Moldova's net imports (goods and services) in the 12-month period to June 2023. The coverage ratio was only 54% in the previous 12-month period, despite the lower value of the trade deficit.

But the net net wage remittances and net personal transfers added up in the 12-month period to June 2023 to only $1.6bn (not much changed from the previous 12-month period), meaning that households cashed $1.4bn of their savings.

For comparison, Moldova’s public debt (public and private) rose five times faster than the previous 12-month period, still by only $1.6bn to $10.2bn – matching the wage remittances and the personal transfers generated by households over the period.

Moldova’s foreign trade is now returning to normal after the energy price shock.

The trade deficit increased by 7% y/y to $4.83bn (€4.53bn) in the 12-month period to September 2023, slightly below the $4.88bn recorded in 2022.

59 SE Outlook 2024 www.intellinews.com