Page 74 - bne IntelliNews SE Outlook Regions 2024

P. 74

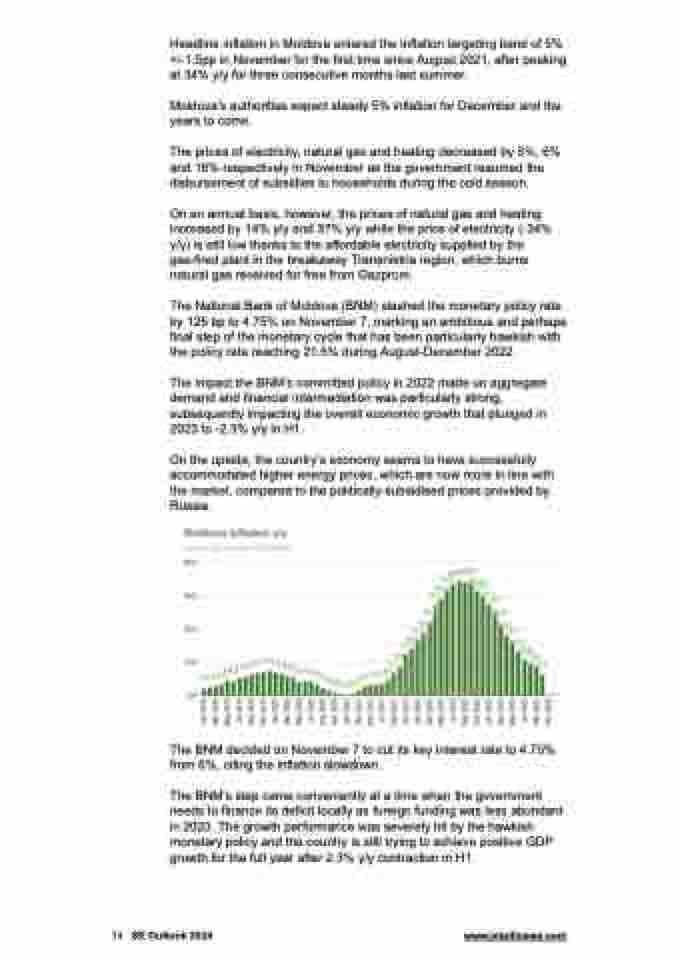

Headline inflation in Moldova entered the inflation targeting band of 5% +/-1.5pp in November for the first time since August 2021, after peaking at 34% y/y for three consecutive months last summer.

Moldova’s authorities expect steady 5% inflation for December and the years to come.

The prices of electricity, natural gas and heating decreased by 5%, 6% and 18% respectively in November as the government resumed the disbursement of subsidies to households during the cold season.

On an annual basis, however, the prices of natural gas and heating increased by 14% y/y and 37% y/y while the price of electricity (-34% y/y) is still low thanks to the affordable electricity supplied by the gas-fired plant in the breakaway Transnistria region, which burns natural gas received for free from Gazprom.

The National Bank of Moldova (BNM) slashed the monetary policy rate by 125 bp to 4.75% on November 7, marking an ambitious and perhaps final step of the monetary cycle that has been particularly hawkish with the policy rate reaching 21.5% during August-December 2022.

The impact the BNM’s committed policy in 2022 made on aggregate demand and financial intermediation was particularly strong, subsequently impacting the overall economic growth that plunged in 2023 to -2.3% y/y in H1.

On the upside, the country’s economy seems to have successfully accommodated higher energy prices, which are now more in line with the market, compared to the politically-subsidised prices provided by Russia.

The BNM decided on November 7 to cut its key interest rate to 4.75% from 6%, citing the inflation slowdown.

The BNM’s step came conveniently at a time when the government needs to finance its deficit locally as foreign funding was less abundant in 2023. The growth performance was severely hit by the hawkish monetary policy and the country is still trying to achieve positive GDP growth for the full year after 2.3% y/y contraction in H1.

74 SE Outlook 2024 www.intellinews.com