Page 79 - bne IntelliNews SE Outlook Regions 2024

P. 79

4.10 Inflation & Monetary Policy - Serbia

In Serbia, year-on-year inflation has followed a downward trajectory, reaching 8.5% in October. The disinflation process was mainly driven by the ongoing deceleration in food price growth and a slowdown in the growth of core inflation (CPI excluding food, energy, alcohol, and cigarettes) to 7.3% y/y. October's food price growth, at 10.5% y/y, was the lowest in the past two years.

Inflation is anticipated to decrease further to around or below 8% by end-2023, returning within the target band in mid-2024 and converging toward the 3% target midpoint by the end of 2024, according to the central bank.

The projected trajectory hinges on the effects of monetary tightening, the slowdown in imported inflation, and the expected further decline in inflation expectations.

Finance Minister Sinisa Mali said in December 2023 he expects inflation will decrease further, reaching a range of 3.5% to 4% in the coming year.

The IMF predicts that consumer prices in Serbia will increase by 12.4% in 2023 and slow to 5.3% in 2024 following an annual inflation rate of 12% in 2022.

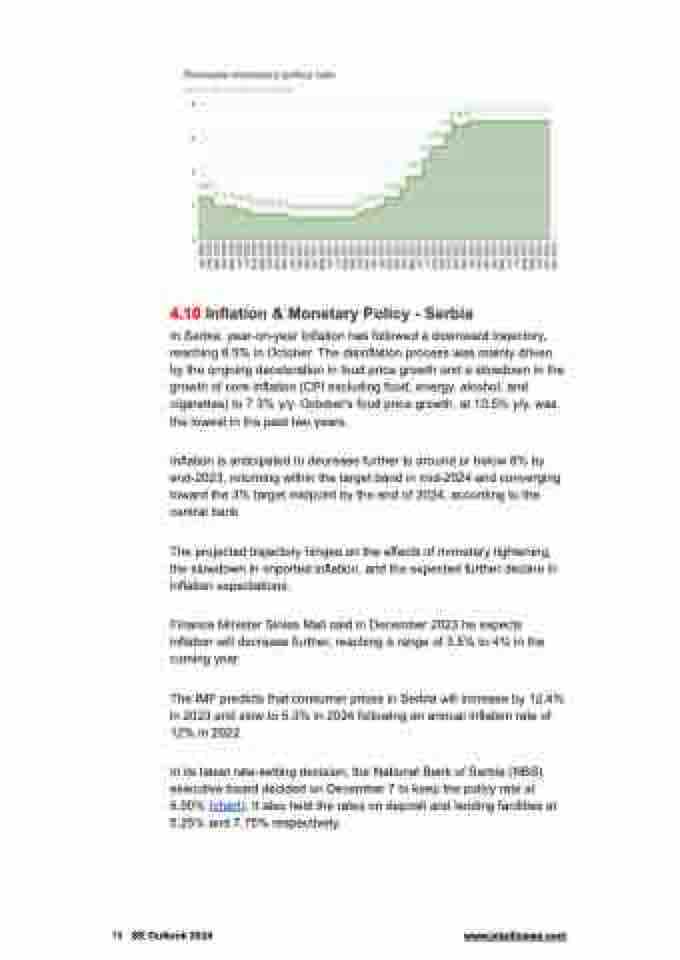

In its latest rate-setting decision, the National Bank of Serbia (NBS) executive board decided on December 7 to keep the policy rate at 6.50% (chart). It also held the rates on deposit and lending facilities at 5.25% and 7.75% respectively.

79 SE Outlook 2024 www.intellinews.com