Page 58 - bne IntelliNews monthly magazine November 2024

P. 58

58 I New Europe in Numbers bne November 2024

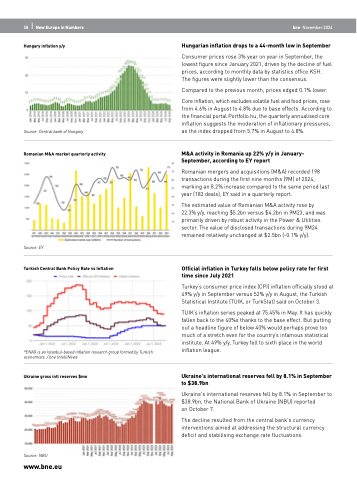

Hungary inflation y/y

Hungarian inflation drops to a 44-month low in September

Consumer prices rose 3% year on year in September, the lowest figure since January 2021, driven by the decline of fuel prices, according to monthly data by statistics office KSH. The figures were slightly lower than the consensus.

Compared to the previous month, prices edged 0.1% lower.

Core inflation, which excludes volatile fuel and food prices, rose from 4.6% in August to 4.8% due to base effects. According to the financial portal Portfolio.hu, the quarterly annualised core inflation suggests the moderation of inflationary pressures, as the index dropped from 5.7% in August to 4.8%.

M&A activity in Romania up 22% y/y in January- September, according to EY report

Romanian mergers and acquisitions (M&A) recorded 198 transactions during the first nine months (9M) of 2024, marking an 8.2% increase compared to the same period last year (183 deals), EY said in a quarterly report.

The estimated value of Romanian M&A activity rose by 22.3% y/y, reaching $5.2bn versus $4.2bn in 9M23, and was primarily driven by robust activity in the Power & Utilities sector. The value of disclosed transactions during 9M24 remained relatively unchanged at $2.5bn (-0.1% y/y).

Official inflation in Turkey falls below policy rate for first time since July 2021

Turkey’s consumer price index (CPI) inflation officially stood at 49% y/y in September versus 52% y/y in August, the Turkish Statistical Institute (TUIK, or TurkStat) said on October 3.

TUIK’s inflation series peaked at 75.45% in May. It has quickly fallen back to the 40%s thanks to the base effect. But putting out a headline figure of below 40% would perhaps prove too much of a stretch even for the country’s infamous statistical institute. At 49% y/y, Turkey fell to sixth place in the world inflation league.

Ukraine's international reserves fell by 8.1% in September to $38.9bn

Ukraine's international reserves fell by 8.1% in September to $38.9bn, the National Bank of Ukraine (NBU) reported

on October 7.

The decline resulted from the central bank's currency interventions aimed at addressing the structural currency deficit and stabilising exchange rate fluctuations.

Source: Central bank of Hungary

Romanian M&A market quarterly activity

Source: EY

Turkish Central Bank Policy Rate vs Inflation

*ENAG is an Istanbul-based inflation research group formed by Turkish economists. / bne IntelliNews

Ukraine gross intl reserves $mn

Source: NBU

www.bne.eu