Page 73 - RusRPTJul23

P. 73

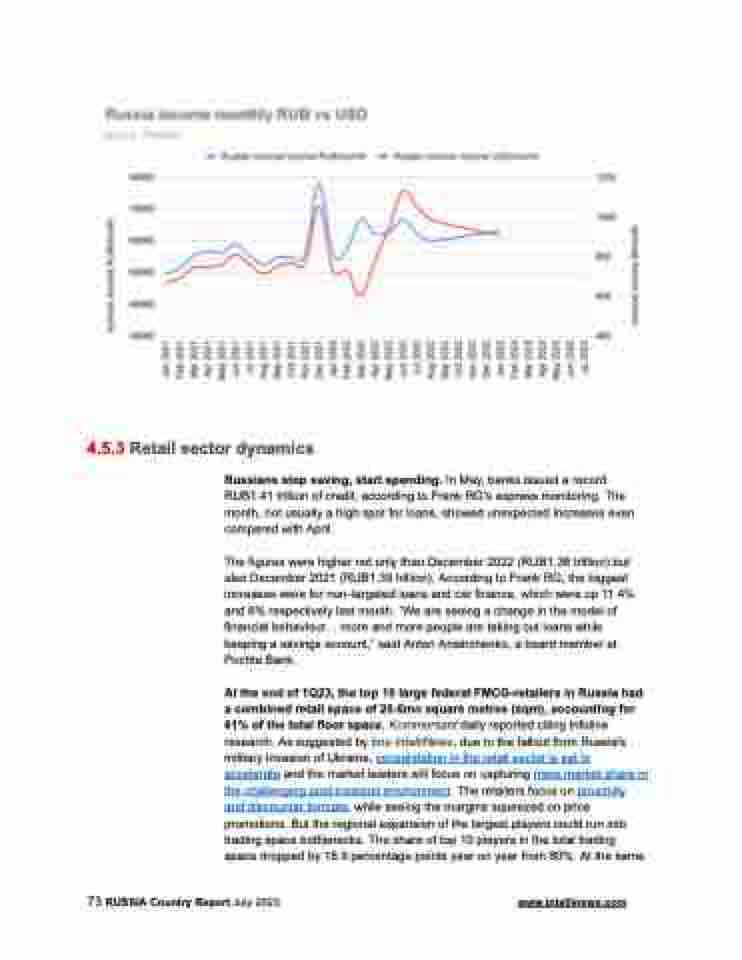

4.5.3 Retail sector dynamics

Russians stop saving, start spending. In May, banks issued a record RUB1.41 trillion of credit, according to Frank RG’s express monitoring. The month, not usually a high spot for loans, showed unexpected increases even compared with April.

The figures were higher not only than December 2022 (RUB1.38 trillion) but also December 2021 (RUB1.39 trillion). According to Frank RG, the biggest increases were for non-targeted loans and car finance, which were up 11.4% and 8% respectively last month. “We are seeing a change in the model of financial behaviour... more and more people are taking out loans while keeping a savings account,” said Anton Anishchenko, a board member at Pochta Bank.

At the end of 1Q23, the top 10 large federal FMCG-retailers in Russia had a combined retail space of 20.6mn square metres (sqm), accounting for 61% of the total floor space, Kommersant daily reported citing Infoline research. As suggested by bne IntelliNews, due to the fallout from Russia's military invasion of Ukraine, consolidation in the retail sector is set to accelerate and the market leaders will focus on capturing more market share in the challenging post-invasion environment. The retailers focus on proximity and discounter formats, while seeing the margins squeezed on price promotions. But the regional expansion of the largest players could run into trading space bottlenecks. The share of top 10 players in the total trading space dropped by 18.9 percentage points year on year from 80%. At the same

73 RUSSIA Country Report July 2023 www.intellinews.com