Page 24 - IRANRptAug22

P. 24

4.4 Gross fixed capital formation

Capital expenditure is strong

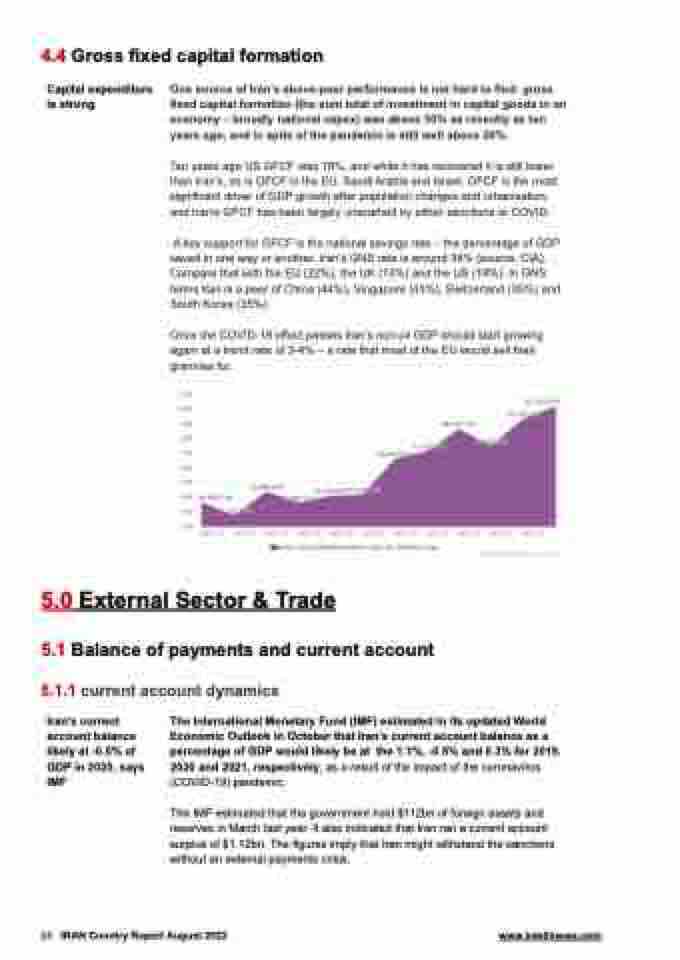

One source of Iran’s above-peer performance is not hard to find: gross fixed capital formation (the sum total of investment in capital goods in an economy – broadly national capex) was above 30% as recently as ten years ago, and in spite of the pandemic is still well above 20%.

Ten years ago US GFCF was 18%, and while it has recovered it is still lower than Iran’s, as is GFCF in the EU, Saudi Arabia and Israel. GFCF is the most significant driver of GDP growth after population changes and urbanisation, and Iran’s GFCF has been largely unscathed by either sanctions or COVID.

A key support for GFCF is the national savings rate – the percentage of GDP saved in one way or another. Iran’s GNS rate is around 38% (source: CIA). Compare that with the EU (22%), the UK (13%) and the US (18%). In GNS terms Iran is a peer of China (44%), Singapore (43%), Switzerland (35%) and South Korea (35%).

Once the COVID-19 effect passes Iran’s non-oil GDP should start growing again at a trend rate of 3-4% – a rate that most of the EU would sell their grannies for.

5.0 External Sector & Trade

5.1 Balance of payments and current account

5.1.1 current account dynamics

Iran’s current account balance likely at -0.5% of GDP in 2020, says IMF

The International Monetary Fund (IMF) estimated in its updated World Economic Outlook in October that Iran’s current account balance as a percentage of GDP would likely be at the 1.1%, -0.5% and 0.3% for 2019, 2020 and 2021, respectively, as a result of the impact of the coronavirus (COVID-19) pandemic.

The IMF estimated that the government held $112bn of foreign assets and reserves in March last year. It also indicated that Iran ran a current account surplus of $1.12bn. The figures imply that Iran might withstand the sanctions without an external payments crisis.

24 IRAN Country Report August 2022 www.intellinews.com