Page 78 - bne magazine July 2022_20220704

P. 78

78 Opinion

bne July 2022

The world continues to hurtle towards recession and potentially financial crisis

Les Nemethy

Over the past month, I have travelled within North America and Western Europe, met quite a few people, including senior bankers, and have been generally surprised by the feeling of ‘business as usual’. There is very little sense of impending doom or recession. Reasons given include:

• Strength in the US job market;

• High aggregate savings and bank deposit levels of US consumers.

• US Federal deficit has decreased to $1.1 trillion in May 2022, down from a peak of $4.3 trillion in March 2021 (measured on a 12-month trailing basis).

Why do I believe this confidence is misplaced?

• The Michigan consumer confidence index is at its lowest since 1980.

• The distribution of those savings is skewed. 60% of Americans have little or no savings.

• Jobs reporting is with a lag, and the number of unemployed is already starting to notch upwards.

• Q1 nominal growth in the US was already -1.5%.

• The S&P is down 18.2% in the first 111 trading days of 2022, the fourth worst performance since 1932 – diminishing consumer and investor confidence.

• Inflation continues to increase in most countries in the world, raising the likelihood of further rate increases and the spectre of further economic slowdown and decline in stock market indices.

• Bond yields are generally increasing rapidly worldwide (e.g. in Germany from negative a year ago to over 1.5% on June 10), with yields on the EU periphery rising even faster

www.bne.eu

A global recession is looming that could possibly spark a financial crisis / wiki

(e.g. a year ago 10-year Italian bonds yields were about a percent higher than German bonds, today they are over two percent higher). 10-year Italian bond yield have risen from 1% at the beginning of 2022 to 3,86% on June 1, despite massive bond buying from the ECB. While most believe the ECB will do “whatever it takes to save the euro” (as Mario Draghi famously said in 2012, turning the tide on the then euro crisis), the magnitude and speed of movement in Italian bond rates is cause for worry.

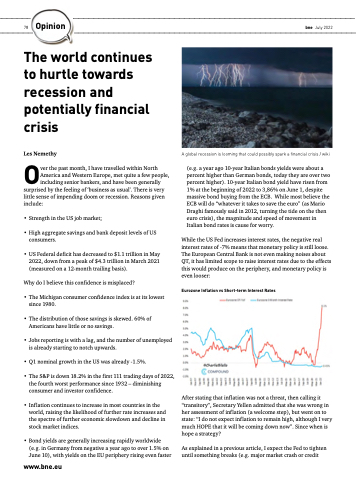

While the US Fed increases interest rates, the negative real interest rates of -7% means that monetary policy is still loose. The European Central Bank is not even making noises about QT, it has limited scope to raise interest rates due to the effects this would produce on the periphery, and monetary policy is even looser:

Eurozone Inflation vs Short-term Interest Rates

After stating that inflation was not a threat, then calling it “transitory”, Secretary Yellen admitted that she was wrong in her assessment of inflation (a welcome step), but went on to state: “I do not expect inflation to remain high, although I very much HOPE that it will be coming down now”. Since when is hope a strategy?

As explained in a previous article, I expect the Fed to tighten until something breaks (e.g. major market crash or credit