Page 84 - bne magazine July 2022_20220704

P. 84

84 I New Europe in Numbers bne July 2022

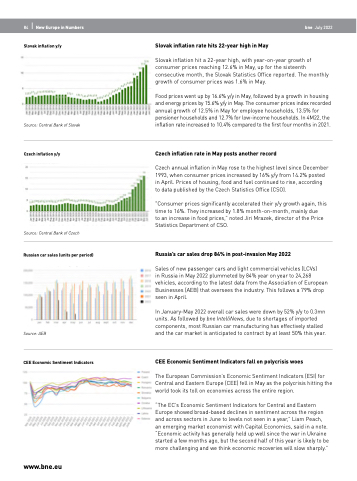

Slovak inflation y/y

Slovak inflation rate hits 22-year high in May

Source: Central Bank of Slovak

Czech inflation y/y

Slovak inflation hit a 22-year high, with year-on-year growth of consumer prices reaching 12.6% in May, up for the sixteenth consecutive month, the Slovak Statistics Office reported. The monthly growth of consumer prices was 1.6% in May.

Food prices went up by 16.6% y/y in May, followed by a growth in housing and energy prices by 15.6% y/y in May. The consumer prices index recorded annual growth of 12.5% in May for employee households, 13.5% for pensioner households and 12.7% for low-income households. In 4M22, the inflation rate increased to 10.4% compared to the first four months in 2021.

Czech inflation rate in May posts another record

Czech annual inflation in May rose to the highest level since December 1993, when consumer prices increased by 16% y/y from 14.2% posted in April. Prices of housing, food and fuel continued to rise, according to data published by the Czech Statistics Office (CSO).

"Consumer prices significantly accelerated their y/y growth again, this time to 16%. They increased by 1.8% month-on-month, mainly due

to an increase in food prices,” noted Jiri Mrazek, director of the Price Statistics Department of CSO.

Russia’s car sales drop 84% in post-invasion May 2022

Sales of new passenger cars and light commercial vehicles (LCVs)

in Russia in May 2022 plummeted by 84% year on year to 24,268 vehicles, according to the latest data from the Association of European Businesses (AEB) that oversees the industry. This follows a 79% drop seen in April.

In January-May 2022 overall car sales were down by 52% y/y to 0.3mn units. As followed by bne IntelliNews, due to shortages of imported components, most Russian car manufacturing has effectively stalled and the car market is anticipated to contract by at least 50% this year.

CEE Economic Sentiment Indicators fall on polycrisis woes

The European Commission’s Economic Sentiment Indicators (ESI) for Central and Eastern Europe (CEE) fell in May as the polycrisis hitting the world took its toll on economies across the entire region.

“The EC’s Economic Sentiment Indicators for Central and Eastern Europe showed broad-based declines in sentiment across the region and across sectors in June to levels not seen in a year,” Liam Peach, an emerging market economist with Capital Economics, said in a note. “Economic activity has generally held up well since the war in Ukraine started a few months ago, but the second half of this year is likely to be more challenging and we think economic recoveries will slow sharply.”

Source: Central Bank of Czech

Russian car sales (units per period)

Source: AEB

CEE Economic Sentiment Indicators

www.bne.eu