Page 50 - Russia OUTLOOK 2024

P. 50

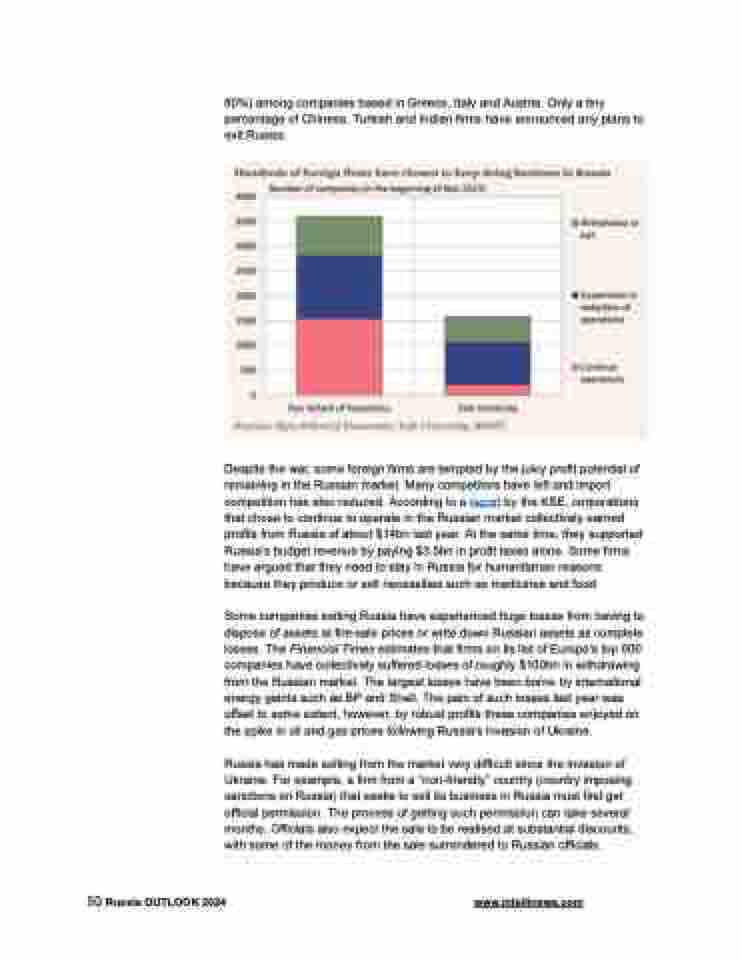

80%) among companies based in Greece, Italy and Austria. Only a tiny percentage of Chinese, Turkish and Indian firms have announced any plans to exit Russia.

Despite the war, some foreign firms are tempted by the juicy profit potential of remaining in the Russian market. Many competitors have left and import competition has also reduced. According to a report by the KSE, corporations that chose to continue to operate in the Russian market collectively earned profits from Russia of about $14bn last year. At the same time, they supported Russia’s budget revenue by paying $3.5bn in profit taxes alone. Some firms have argued that they need to stay in Russia for humanitarian reasons because they produce or sell necessities such as medicines and food.

Some companies exiting Russia have experienced huge losses from having to dispose of assets at fire-sale prices or write down Russian assets as complete losses. The Financial Times estimates that firms on its list of Europe’s top 600 companies have collectively suffered losses of roughly $100bn in withdrawing from the Russian market. The largest losses have been borne by international energy giants such as BP and Shell. The pain of such losses last year was offset to some extent, however, by robust profits these companies enjoyed on the spike in oil and gas prices following Russia’s invasion of Ukraine.

Russia has made exiting from the market very difficult since the invasion of Ukraine. For example, a firm from a “non-friendly” country (country imposing sanctions on Russia) that seeks to sell its business in Russia must first get official permission. The process of getting such permission can take several months. Officials also expect the sale to be realised at substantial discounts, with some of the money from the sale surrendered to Russian officials.

50 Russia OUTLOOK 2024 www.intellinews.com