Page 69 - bne monthly magazine June 2024 Russian Despair Index

P. 69

bne June 2024 Eurasia I 69

But since the October 7 attacks by Hamas on Israel and the rapidly deteriorating situation following Israel’s attack on the Gaza strip, this plan has had to be reworked.

Given the problems in the countries surrounding Israel are unlikely to go away quickly, an alternative is emerging where goods are landed at the top of the Persian Gulf and then transported across Iraq and Turkey to enter Europe that way.

India is keen to expand its connections to Europe by land; these are currently bottled up thanks to poor relations with Pakistan and instability in Afghanistan, which are both in the way. The Central Asian states would love to see a southern route out of their region open up as well, as currently they are forced to trade and transport across the long Russia border which shuts them in to the north, and Iran, which has similar sanctions problems, to the south.

The EU is also keen to see the route established, because if it significantly increases its trade with India via the route it will also give it new leverage in the Middle East, where currently it has limited influence.

KSA is also keen to cooperate with India. While Riyadh has been moving closer to the BRICS group led by Russia and China – it has agreed in principle to join BRICS+ – Riyadh has surprised by throwing in its lot with the Indian transport corridor proposal that has been backed by both the US and EU. Crown Prince Mohammed bin Salman (MbS) is clearly trying to improve KSA’s clout on the international stage and is following a multivector foreign policy that is popular throughout Eurasia. At the same time as improving relations with the more pro-market India, MbS is buying some political leverage in

his relations with the more politically aggressive Beijing and Moscow.

A coalition involving Iraq, Turkey, Qatar and the UAE signed an MoU in February to enhance trade connectivity between India and Europe by creating a new trade corridor to rival the existing IMEC and seaborne Suez Canal routes.

Last year, Iraq launched a $17bn project to connect a major commodities port on its southern coast to the Turkish border via an expansive rail and road network. Known as the Development Road project, it will span over 1,200 kilometres and is designed to transform Iraq into a strategic transit hub linking Asia and Europe.

Sanction free north-south route

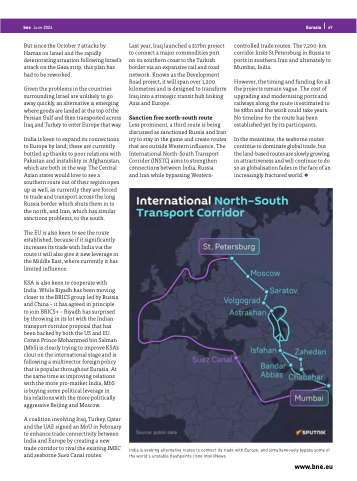

Less prominent, a third route is being discussed as sanctioned Russia and Iran try to stay in the game and create routes that are outside Western influence. The International North-South Transport Corridor (INSTC) aims to strengthen connections between India, Russia

and Iran while bypassing Western-

controlled trade routes. The 7,200-km corridor links St Petersburg in Russia to ports in southern Iran and ultimately to Mumbai, India.

However, the timing and funding for all the projects remain vague. The cost of upgrading and modernising ports and railways along the route is estimated to be $8bn and the work could take years. No timeline for the route has been established yet by its participants.

In the meantime, the seaborne routes continue to dominate global trade, but the land-based routes are slowly growing in attractiveness and will continue to do so as globalisation fades in the face of an increasingly fractured world.

India is seeking alternative routes to connect its trade with Europe, and simultaneously bypass some of the world's unstable flashpoints / bne IntelliNews

www.bne.eu