Page 20 - bne_September 2022_20220802

P. 20

20 I Companies & Markets bne September 2022

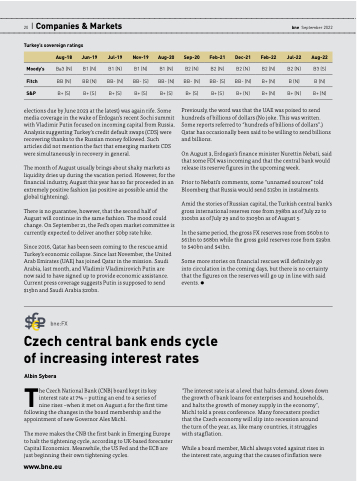

Turkey’s sovereign ratings

Aug-18

Jun-19

Jul-19

Nov-19

Aug-20

Sep-20

Feb-21

Dec-21

Feb-22

Jul-22

Aug-22

Moody’s

Fitch

S&P

Ba3 (N)

BB (N)

B+ (S)

B1 (N)

BB (N)

B+ (S)

B1 (N)

BB- (N)

B+ (S)

B1 (N)

BB- (S)

B+ (S)

B1 (N)

BB- (N)

B+ (S)

B2 (N)

BB- (N)

B+ (S)

B2 (N)

BB- (S)

B+ (S)

B2 (N)

BB- (N)

B+ (N)

B2 (N)

B+ (N)

B+ (N)

B2 (N)

B (N)

B+ (N)

B3 (S)

B (N)

B+ (N)

elections due by June 2023 at the latest) was again rife. Some media coverage in the wake of Erdogan’s recent Sochi summit with Vladimir Putin focused on incoming capital from Russia. Analysis suggesting Turkey’s credit default swaps (CDS) were recovering thanks to the Russian money followed. Such articles did not mention the fact that emerging markets CDS were simultaneously in recovery in general.

The month of August usually brings about shaky markets as liquidity dries up during the vacation period. However, for the financial industry, August this year has so far proceeded in an extremely positive fashion (as positive as possible amid the global tightening).

There is no guarantee, however, that the second half of August will continue in the same fashion. The mood could change. On September 21, the Fed’s open market committee is currently expected to deliver another 50bp rate hike.

Since 2016, Qatar has been seen coming to the rescue amid Turkey’s economic collapse. Since last November, the United Arab Emirates (UAE) has joined Qatar in the mission. Saudi Arabia, last month, and Vladimir Vladimirovich Putin are now said to have signed up to provide economic assistance. Current press coverage suggests Putin is supposed to send $15bn and Saudi Arabia $20bn.

bne:FX

Previously, the word was that the UAE was poised to send hundreds of billions of dollars (No joke. This was written. Some reports referred to “hundreds of billions of dollars”.) Qatar has occasionally been said to be willing to send billions and billions.

On August 3, Erdogan’s finance minister Nurettin Nebati, said that some FDI was incoming and that the central bank would release its reserve figures in the upcoming week.

Prior to Nebati’s comments, some “unnamed sources” told Bloomberg that Russia would send $15bn in instalments.

Amid the stories of Russian capital, the Turkish central bank’s gross international reserves rose from $98bn as of July 22 to $101bn as of July 29 and to $109bn as of August 5.

In the same period, the gross FX reserves rose from $60bn to $61bn to $68bn while the gross gold reserves rose from $39bn to $40bn and $41bn.

Some more stories on financial rescues will definitely go into circulation in the coming days, but there is no certainty that the figures on the reserves will go up in line with said events.

Czech central bank ends cycle

of increasing interest rates Albin Sybera

The Czech National Bank (CNB) board kept its key interest rate at 7% – putting an end to a series of nine rises –when it met on August 4 for the first time following the changes in the board membership and the appointment of new Governor Ales Michl.

The move makes the CNB the first bank in Emerging Europe to halt the tightening cycle, according to UK-based forecaster Capital Economics. Meanwhile, the US Fed and the ECB are just beginning their own tightening cycles.

www.bne.eu

"The interest rate is at a level that halts demand, slows down the growth of bank loans for enterprises and households, and halts the growth of money supply in the economy", Michl told a press conference. Many forecasters predict that the Czech economy will slip into recession around

the turn of the year, as, like many countries, it struggles with stagflation.

While a board member, Michl always voted against rises in the interest rate, arguing that the causes of inflation were