Page 50 - UKRRptAug23

P. 50

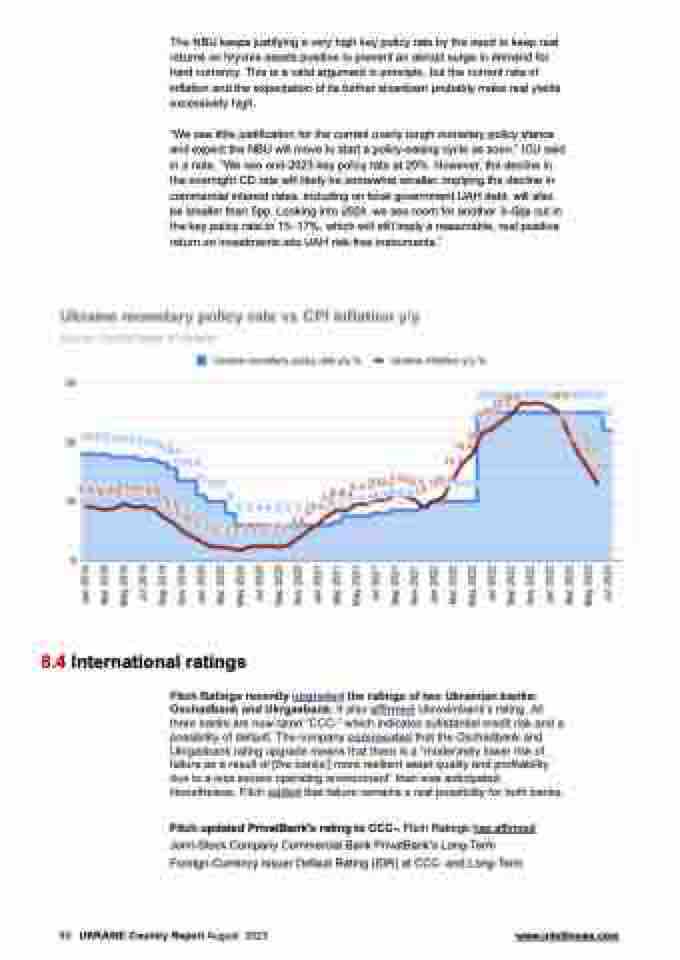

The NBU keeps justifying a very high key policy rate by the need to keep real returns on hryvnia assets positive to prevent an abrupt surge in demand for hard currency. This is a valid argument in principle, but the current rate of inflation and the expectation of its further slowdown probably make real yields excessively high.

“We see little justification for the current overly tough monetary policy stance and expect the NBU will move to start a policy-easing cycle as soon,” ICU said in a note. “We see end-2023 key policy rate at 20%. However, the decline in the overnight CD rate will likely be somewhat smaller, implying the decline in commercial interest rates, including on local government UAH debt, will also be smaller than 5pp. Looking into 2024, we see room for another 3‒5pp cut in the key policy rate to 15‒17%, which will still imply a reasonable, real positive return on investments into UAH risk-free instruments.”

8.4 International ratings

Fitch Ratings recently upgraded

added

Fitch updated PrivatBank's rating to CCC-. Fitch Ratings has affirmed Joint-Stock Company Commercial Bank PrivatBank's Long-Term Foreign-Currency Issuer Default Rating (IDR) at CCC- and Long-Term

the ratings of two Ukrainian banks:

Oschadbank and Ukrgasbank. It also

affirmed

Ukreximbank’s rating. All

three banks are now rated “CCC-” which indicates substantial credit risk and a

possibility of default. The company

commented

that the Oschadbank and

Ukrgasbank rating upgrade means that there is a “moderately lower risk of

failure as a result of [the banks’] more resilient asset quality and profitability

due to a less severe operating environment” than was anticipated.

Nonetheless, Fitch

that failure remains a real possibility for both banks.

50 UKRAINE Country Report August 2023 www.intellinews.com