Page 42 - UKRRptOct23

P. 42

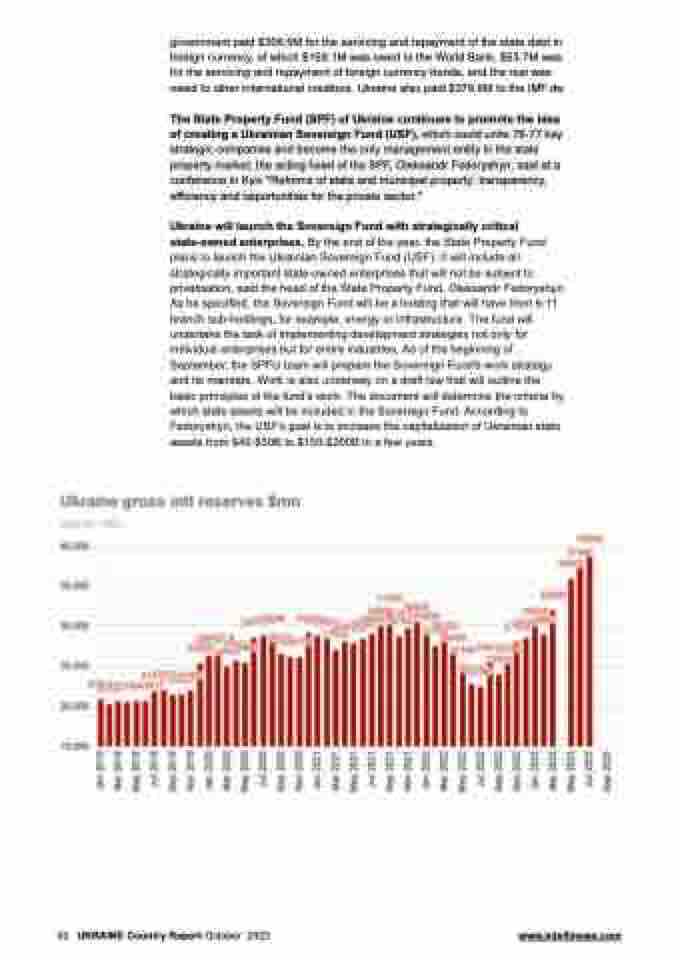

government paid $306.5M for the servicing and repayment of the state debt in foreign currency, of which $169.1M was owed to the World Bank, $63.7M was for the servicing and repayment of foreign currency bonds, and the rest was owed to other international creditors. Ukraine also paid $379.6M to the IMF.dw

Ukraine will launch the Sovereign Fund with strategically critical state-owned enterprises. By the end of the year, the State Property Fund plans to launch the Ukrainian Sovereign Fund (USF). It will include all strategically important state-owned enterprises that will not be subject to privatisation, said the head of the State Property Fund, Oleksandr Fedoryshyn. As he specified, the Sovereign Fund will be a holding that will have from 6-11 branch sub-holdings, for example, energy or infrastructure. The fund will undertake the task of implementing development strategies not only for individual enterprises but for entire industries. As of the beginning of September, the SPFU team will prepare the Sovereign Fund's work strategy and its mandate. Work is also underway on a draft law that will outline the basic principles of the fund's work. The document will determine the criteria by which state assets will be included in the Sovereign Fund. According to Fedoryshyn, the USF's goal is to increase the capitalization of Ukrainian state assets from $40-$50B to $150-$200B in a few years.

The State Property Fund (SPF) of Ukraine continues to promote the idea

of creating a Ukrainian Sovereign Fund (USF), which could unite 76-77 key

strategic companies and become the only management entity in the state

property market, the acting head of the SPF, Oleksandr Fedoryshyn, said at a

conference in Kyiv "Reforms of state and municipal property: transparency,

efficiency and opportunities for the private sector."

42 UKRAINE Country Report October 2023 www.intellinews.com