Page 57 - UKRRptOct23

P. 57

does the state owe the most? According to the Ministry of Finance, Ukraine's state and state-guaranteed debt increased by $1.01B in August because the state budget received the seventh tranche of €1.5B of macro-financial assistance from the EU. With that, at the end of the month, state and state-guaranteed debt amounted to $133.93B. The largest portion of the debt comprises loans from international financial organizations and foreign governments (45.23%). This is followed by borrowing on the domestic market through the sale of government securities (30.21%). In August, the Ministry of Finance held 15 bond auctions and raised ₴27.25B. The share of debt from securities issued on the foreign market is 18.1%, and other creditors account for 6.46% of the debt. At the same time, since the beginning of the year, the value of state and state-guaranteed debt has decreased by 0.71 percentage points to 6.97%.

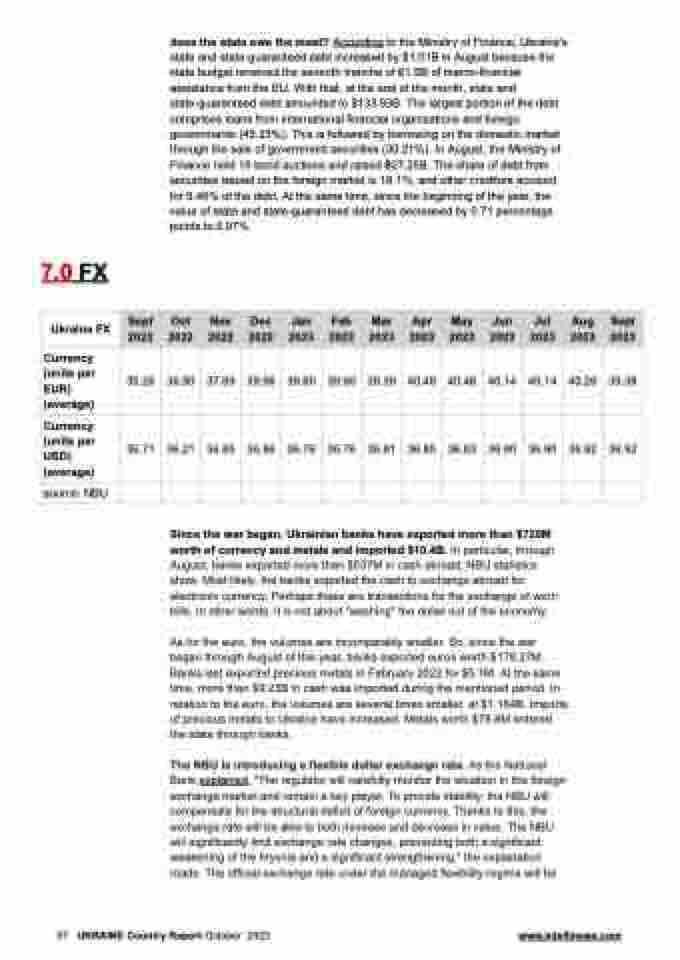

7.0 FX

Ukraine FX

Sept 2022

Oct 2022

Nov 2022

Dec 2022

Jan 2023

Feb 2023

Mar 2023

Apr 2023

May 2023

Jun 2023

Jul 2023

Aug 2023

Sept 2023

Currency (units per EUR) (average)

35.26

36.90

37.69

39.06

39.60

39.60

39.39

40.48

40.48

40.14

40.14

40.26

39.38

Currency (units per USD) (average)

36.71

36.21

36.85

36.86

36.76

36.76

36.81

36.85

36.83

36.90

36.90

36.92

36.92

source: NBU

Since the war began, Ukrainian banks have exported more than $720M worth of currency and metals and imported $10.4B. In particular, through August, banks exported more than $537M in cash abroad, NBU statistics show. Most likely, the banks exported the cash to exchange abroad for electronic currency. Perhaps these are transactions for the exchange of worn bills. In other words, it is not about "washing" the dollar out of the economy.

As for the euro, the volumes are incomparably smaller. So, since the war began through August of this year, banks exported euros worth $178.27M. Banks last exported precious metals in February 2022 for $5.1M. At the same time, more than $9.23B in cash was imported during the mentioned period. In relation to the euro, the volumes are several times smaller, at $1.164B. Imports of precious metals to Ukraine have increased. Metals worth $78.8M entered the state through banks.

The NBU is introducing a flexible dollar exchange rate. As the National Bank explained, "The regulator will carefully monitor the situation in the foreign exchange market and remain a key player. To provide stability, the NBU will compensate for the structural deficit of foreign currency. Thanks to this, the exchange rate will be able to both increase and decrease in value. The NBU will significantly limit exchange rate changes, preventing both a significant weakening of the hryvnia and a significant strengthening," the explanation reads. The official exchange rate under the managed flexibility regime will be

57 UKRAINE Country Report October 2023 www.intellinews.com