Page 71 - UKRRptOct23

P. 71

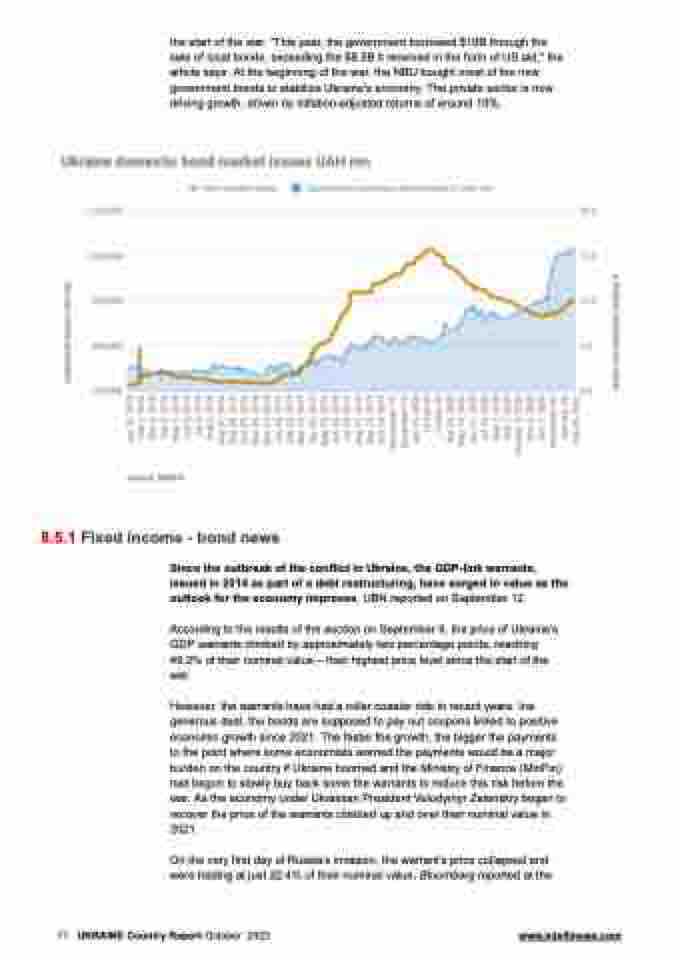

the start of the war. "This year, the government borrowed $10B through the sale of local bonds, exceeding the $8.5B it received in the form of US aid," the article says. At the beginning of the war, the NBU bought most of the new government bonds to stabilize Ukraine's economy. The private sector is now driving growth, driven by inflation-adjusted returns of around 10%.

8.5.1 Fixed income - bond news

Since the outbreak of the conflict in Ukraine, the GDP-link warrants, issued in 2014 as part of a debt restructuring, have surged in value as the outlook for the economy improves, UBN reported on September 12.

According to the results of the auction on September 8, the price of Ukraine's GDP warrants climbed by approximately two percentage points, reaching 49.2% of their nominal value – their highest price level since the start of the war.

However, the warrants have had a roller coaster ride in recent years. Ina generous deal, the bonds are supposed to pay out coupons linked to positive economic growth since 2021. The faster the growth, the bigger the payments to the point where some economists worried the payments would be a major burden on the country if Ukraine boomed and the Ministry of Finance (MinFin) had begun to slowly buy back some the warrants to reduce this risk before the war. As the economy under Ukrainian President Volodymyr Zelenskiy began to recover the price of the warrants climbed up and over their nominal value in 2021.

On the very first day of Russia’s invasion, the warrant’s price collapsed and were trading at just 22.4% of their nominal value, Bloomberg reported at the

71 UKRAINE Country Report October 2023 www.intellinews.com