Page 73 - UKRRptFeb24

P. 73

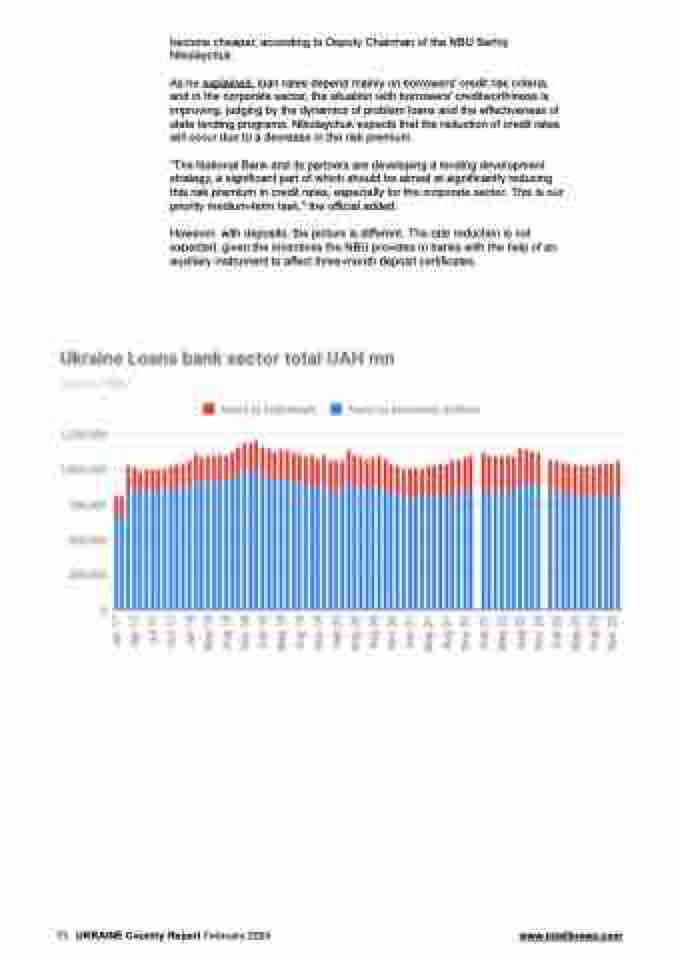

become cheaper, according to Deputy Chairman of the NBU Serhiy Nikolaychuk.

As he explained, loan rates depend mainly on borrowers' credit risk criteria, and in the corporate sector, the situation with borrowers' creditworthiness is improving, judging by the dynamics of problem loans and the effectiveness of state lending programs. Nikolaychuk expects that the reduction of credit rates will occur due to a decrease in the risk premium.

“The National Bank and its partners are developing a lending development strategy, a significant part of which should be aimed at significantly reducing this risk premium in credit rates, especially for the corporate sector. This is our priority medium-term task," the official added.

However, with deposits, the picture is different. The rate reduction is not expected, given the incentives the NBU provides to banks with the help of an auxiliary instrument to affect three-month deposit certificates.

73 UKRAINE Country Report February 2024 www.intellinews.com