Page 76 - UKRRptFeb24

P. 76

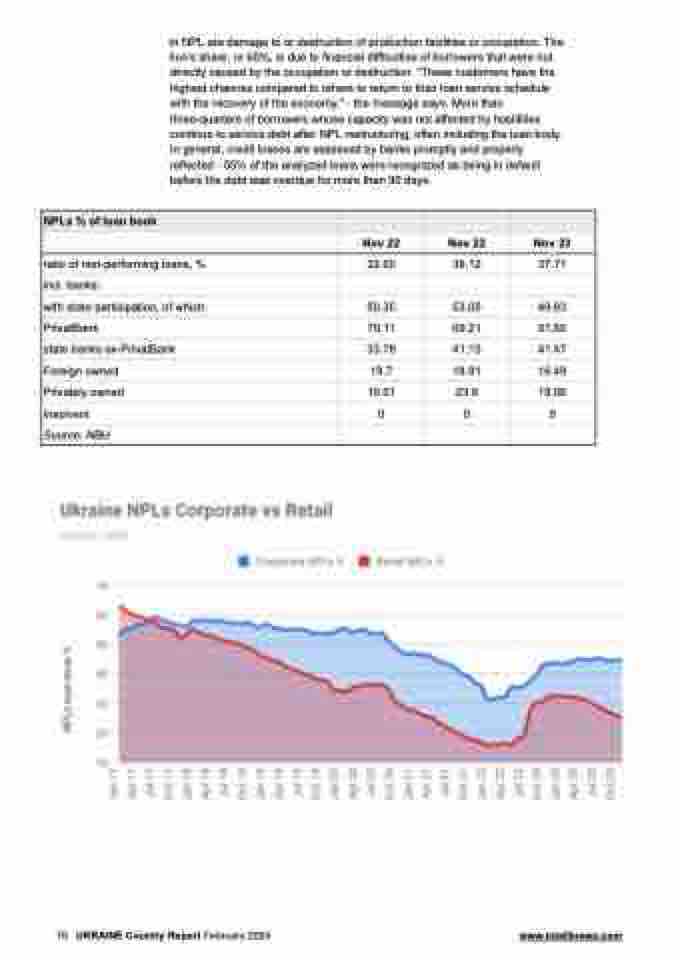

in NPL are damage to or destruction of production facilities or occupation. The lion's share, or 60%, is due to financial difficulties of borrowers that were not directly caused by the occupation or destruction. “These customers have the highest chances compared to others to return to their loan service schedule with the recovery of the economy," - the message says. More than three-quarters of borrowers whose capacity was not affected by hostilities continue to service debt after NPL restructuring, often including the loan body. In general, credit losses are assessed by banks promptly and properly reflected - 55% of the analyzed loans were recognized as being in default before the debt was overdue for more than 90 days.

NPLs % of loan book

Nov 22

Nov 22

Nov 23

ratio of non-performing loans, %

32.65

38.12

37.71

incl. banks:

with state participation, of which:

50.35

53.05

49.83

PrivatBank

70.11

69.21

61.55

state banks ex-PrivatBank

33.78

41.13

41.47

Foreign owned

19.7

18.91

16.49

Privately owned

10.01

23.6

19.06

Insolvent

0

0

0

Source: NBU

76 UKRAINE Country Report February 2024 www.intellinews.com