Page 38 - IRANRptOct22

P. 38

Iran hikes VAT on all tobacco products

Iran has hiked value added tax (VAT) charged on all tobacco products to boost state revenues and deter smoking, Mehr News Agency has reported.

Smoking in Iran is endemic with low-cost local cigarette production being one of the biggest contributors to the poor overall health of people in the country. Currently, packets of locally-produced Camel cigarettes cost less than $1.00. They are made under licence from Japan Tobacco.

Under Article 2 of the updated VAT law, parliamentarians agreed to increase the VAT rate for local and imported cigarettes and tobacco products. The tax increase will push up the price of locally produced cigarettes by 20-30%. The duty to be charged on imported cigarettes has not yet been disclosed. It is likely to be set at over 100%.

Iran, meanwhile, needs to make more headway in facing the tobacco sector challenges of rife smuggling, grey import trading and fake production issues. The severity of the grey market problems became so great that the Rouhani administration, which finished its second term in office last year, promoted local production of international brands including Camel and Winston.

International tobacco players including British American Tobacco, JPI and Japan Tobacco have a presence in Iran.

6.3 Debt

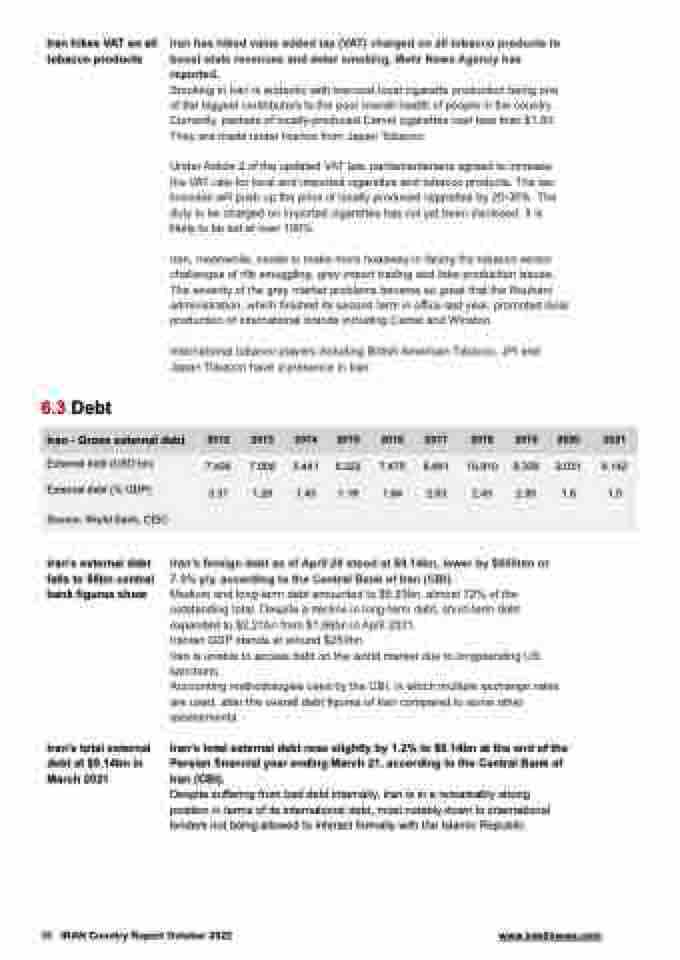

Iran - Gross external debt 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021

External debt (USD bn)

7.406 7.006 5.441 6.322 7.475 8.481 10.910 9.339 9.031 9.142

External debt (% GDP)

3.31 1.28 1.45 1.18 1.94 2.03 2.45 2.05 1.6 1.0

Source: World Bank, CEIC

Iran’s external debt falls to $8bn central bank figures show

Iran’s total external debt at $9.14bn in March 2021

Iran's foreign debt as of April 20 stood at $8.14bn, lower by $650mn or 7.3% y/y, according to the Central Bank of Iran (CBI).

Medium and long-term debt amounted to $5.93bn, almost 72% of the outstanding total. Despite a decline in long-term debt, short-term debt expanded to $2.21bn from $1.86bn in April 2021.

Iranian GDP stands at around $250bn.

Iran is unable to access debt on the world market due to longstanding US sanctions.

Accounting methodologies used by the CBI, in which multiple exchange rates are used, alter the overall debt figures of Iran compared to some other assessments.

Iran's total external debt rose slightly by 1.2% to $9.14bn at the end of the Persian financial year ending March 21, according to the Central Bank of Iran (CBI).

Despite suffering from bad debt internally, Iran is in a remarkably strong position in terms of its international debt, most notably down to international lenders not being allowed to interact formally with the Islamic Republic.

38 IRAN Country Report October 2022 www.intellinews.com