Page 49 - IRANRptSep22

P. 49

Volatility in Iranian share prices has in part been caused by uncertainty over where the ongoing Vienna talks aimed at reviving the nuclear deal between Tehran and world powers are heading.

On January 20, US Secretary of State Antony Blinken said that the talks to revive the nuclear deal, or JCPOA, have reached an "urgent" point following "modest progress" in negotiations.

"There is real urgency and it's really now a matter of weeks, where we determine whether or not we can return to mutual compliance with the agreement," Blinken told reporters.

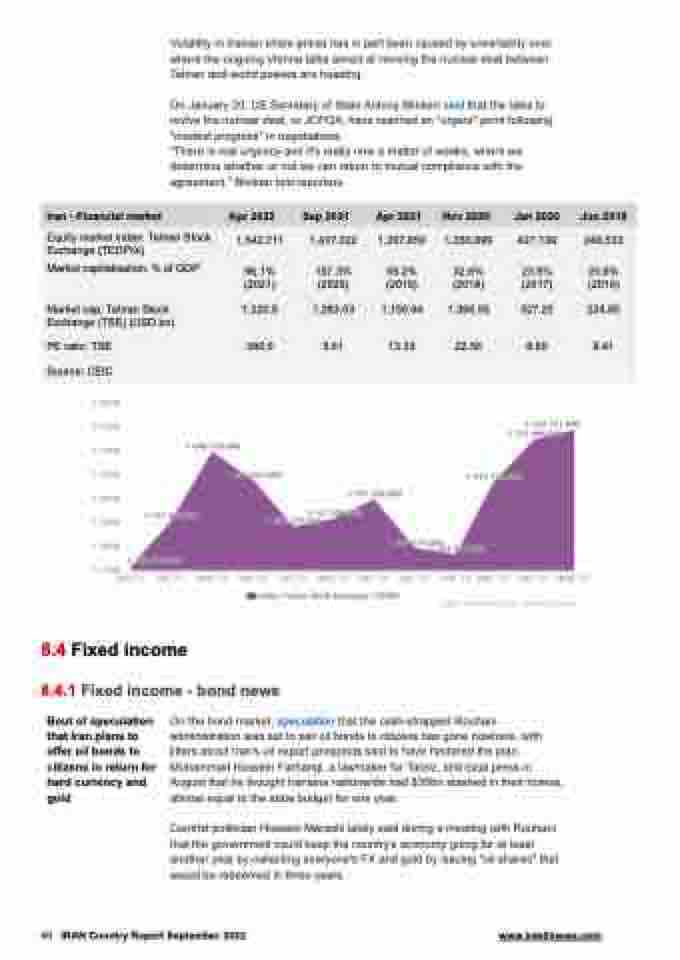

Iran - Financial market Apr 2022 Sep 2021 Apr 2021 Nov 2020 Jan 2020 Jun 2019

Equity market index: Tehran Stock Exchange (TEDPIX)

1,542,711 1,437,022 1,207,850 1,350,899 427,139 248,533

Market capitalisation: % of GDP

96.1% 157.3% 59.2% 32.6% 23.9% 25.6% (2021) (2020) (2019) (2018) (2017) (2016)

Market cap: Tehran Stock 1,220.9 1,283.03 1,150.64 1,366.55 327.20 224.85 Exchange (TSE) (USD bn)

PE ratio: TSE 380.0 9.61 13.33 22.56 8.60 8.41 Source: CEIC

8.4 Fixed income

8.4.1 Fixed income - bond news

Bout of speculation that Iran plans to offer oil bonds to citizens in return for hard currency and gold

On the bond market, speculation that the cash-strapped Rouhani administration was set to sell oil bonds to citizens has gone nowhere, with jitters about Iran’s oil export prospects said to have hindered the plan. Mohammad Hossein Farhangi, a lawmaker for Tabriz, told local press in August that he thought Iranians nationwide had $35bn stashed in their homes, almost equal to the state budget for one year.

Centrist politician Hossein Marashi lately said during a meeting with Rouhani that the government could keep the country's economy going for at least another year by collecting everyone's FX and gold by issuing "oil shares" that would be redeemed in three years.

49 IRAN Country Report September 2022 www.intellinews.com